Business tips for creators to grow smarter. Explore guides on branding, monetization, and management designed to help you build lasting success.

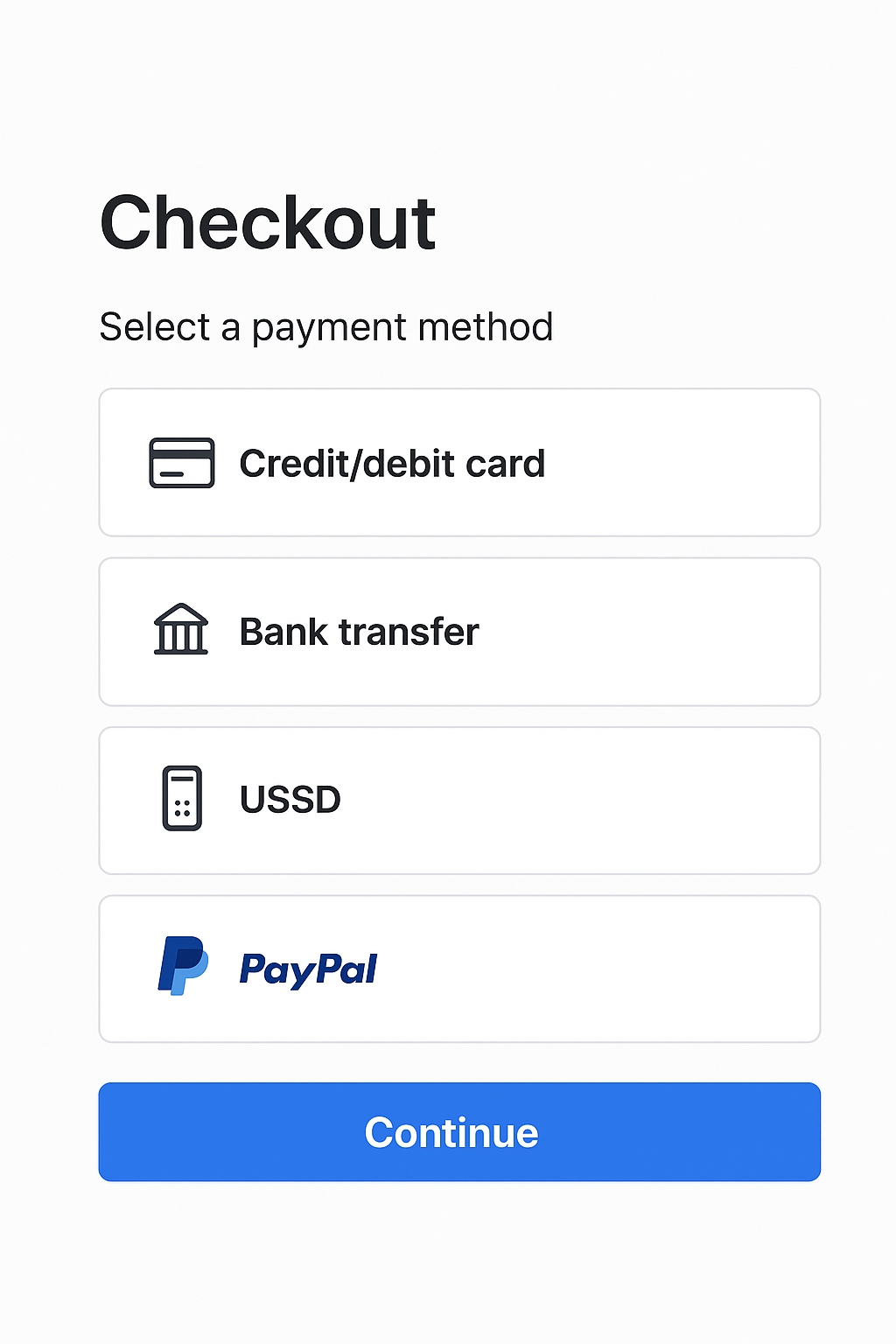

Cross-border transactions make up 40% of global e-commerce, yet businesses struggle with fragmented payment systems and regulatory hurdles. As a digital content provider, education provider, or professional services provider, your market is global. However, most businesses face a significant stumbling block: the complexity of business registrations, compliance, and payment processing barriers that vary from country to country.

This challenge leads to an inefficient solution: establishing separate business entities in multiple countries, each with its own payment processing system. The result is fragmented operations, administrative complexity, and significant costs that make global expansion prohibitive for all but the largest enterprises.

This guide explores how businesses can accept payments globally without the burden of multiple business registrations, using an integrated approach that simplifies international commerce.

Africa's digital economy is booming. Nigeria's fintech sector is thriving, Ghana's mobile money adoption is soaring, Kenya's M-Pesa has set a global standard, and South Africa's tech ecosystem is a continental leader. Yet many African businesses struggle to scale beyond their borders.

The cost of establishing a legal entity in a foreign market ranges from $5,000 to $20,000 per country, including legal fees, registration, and compliance costs, with annual maintenance adding $2,000–$10,000. For small to medium enterprises (SMEs), educational institutions, and individual creators, this represents a significant barrier.

Consider a tutor in Nairobi wanting to offer coding lessons to students in the UK, or a consultant in Accra aiming to advise a startup in Canada. Without a streamlined system for multi-currency payments, these businesses face delays, lost revenue, and frustrated customers.

Traditionally, accepting payments from customers in different countries has involved several complicated steps:

This approach creates significant challenges, including high costs, administrative burden, fragmented customer data, limited scalability, and delayed market entry. For African businesses, this traditional model makes global expansion feel impossible.

An integrated approach to global payments eliminates the need for multiple business registrations while providing the capabilities required to operate internationally. 45% of African businesses using integrated payment platforms reported a 20%+ increase in international sales within six months.

Payment Orchestration vs. Payment Processing

The key difference in modern approaches is payment orchestration rather than direct processing. Payment orchestrators like Mainstack act as intermediaries that:

This orchestration layer allows businesses to accept payments globally through a single platform, without establishing separate entities in each market.

Multi-Currency Support

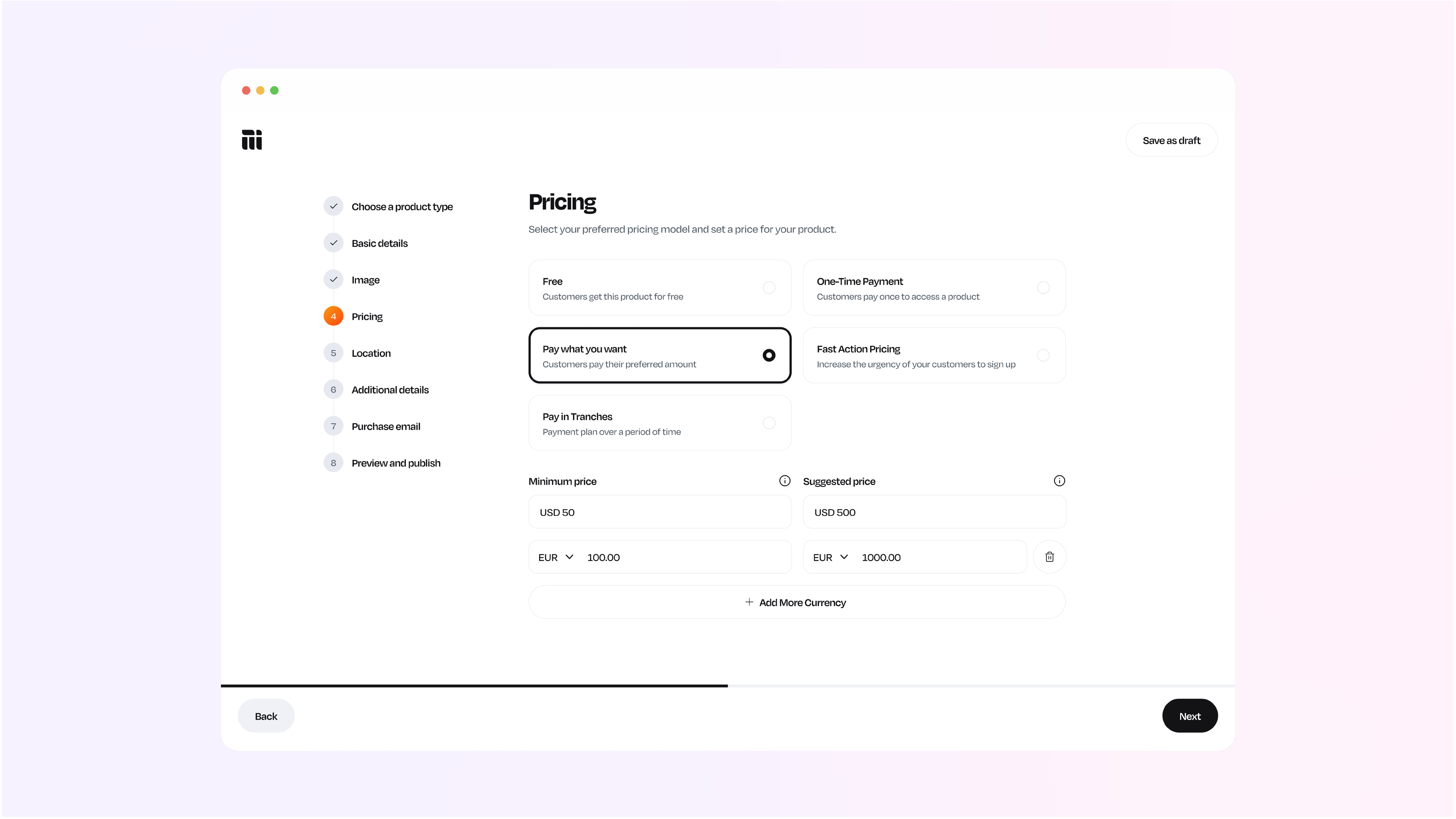

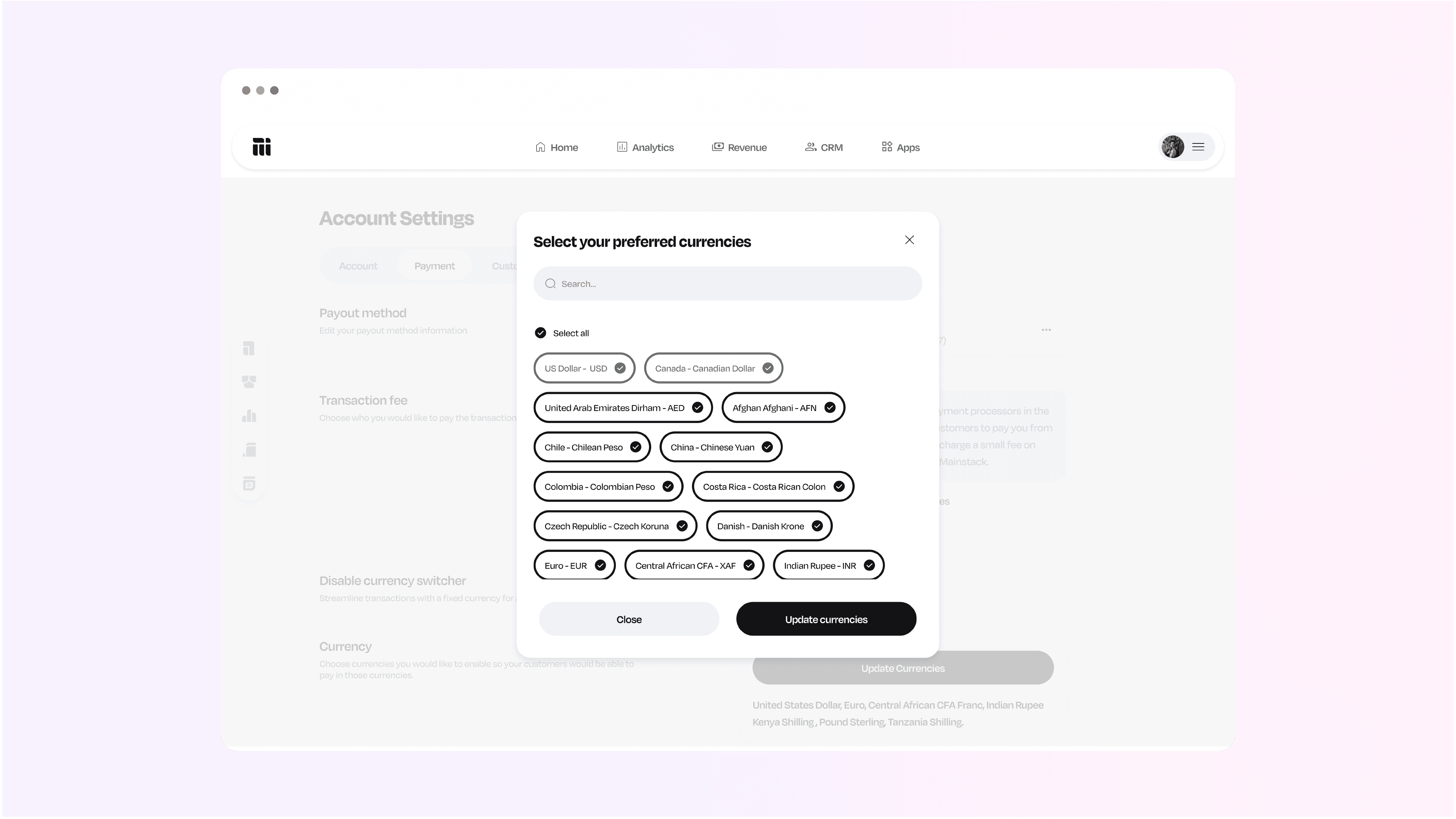

A robust global payment solution must prioritize multi-currency payments. For African businesses, this capability is critical to serving a diverse, international clientele. A platform like Mainstack offers:

This gives customers the comfort of paying in their local currency while allowing you to manage your finances in your preferred currency.

Integrated Business Tools

Beyond payments, an integrated solution provides tools required to run your global business, just like what Mainstack offers:

Step 1: Choose the Right Payment Orchestration Platform

When selecting a platform, look for these essential features:

Mainstack is designed specifically to address these needs, offering a comprehensive solution for global payments without the complexity of multiple business registrations.

Step 2: Set Up Your Global Payment Structure

Setting up your global payment structure is straightforward:

The entire process can be completed in under 30 minutes, compared to the weeks or months required for traditional multi-country setups.

Step 3: Optimize Your Global Offering

With your payment infrastructure in place, focus on optimizing your global business:

The digital payments market is expected to reach $20.37 trillion by the last quarter of 2025. The shift toward integrated global payment solutions represents a fundamental change in how businesses operate internationally. By removing the barriers of multiple registrations and fragmented systems, companies of all sizes can now enter global markets more quickly, scale operations efficiently, and focus resources on growth rather than administration.

For African businesses, this shift is especially transformative, allowing business owners, creators, and entrepreneurs in Nigeria, Ghana, Kenya, and South Africa to reach global customers just as easily as their counterparts in the U.S. or Europe.

The ability to accept payments globally without multiple business registrations is available today through integrated platforms. By taking an approach that combines payment orchestration with essential business tools, companies of all sizes can now build truly global operations without the traditional burdens of multiple registrations.

Your customers worldwide are waiting. With the right approach to global payments, you can reach them without the complexity that has traditionally limited international expansion.

Sign up today for free on Mainstack and start getting paid globally in 135+ currencies without multiple business registrations.

Many beginners starting out in affiliate marketing share a moment of common frustrations. You start affiliate marketing in hopes of earning extra cash, post links, create content, and…crickets. That first sale feels like it's never going to happen.

If you’re reading this, you’re probably on your own Day 1 — curious, hopeful, and maybe a little unsure about where to start. The good news is, you don’t need a huge audience or expensive tools to start earning online.

This guide breaks down how to go from zero to your first $100 in affiliate commissions. You’ll learn what to sell, how to position yourself, where to promote, and who to reach.

By the end, you’ll have a clear roadmap to your first $100 and the confidence to turn it into steady income

You’ve probably heard of affiliate marketing, but what does it really mean?

In plain terms, affiliate marketing is a way to earn money online by promoting other people’s products or services, and when someone buys through your unique link, you earn a commission.

Think of it as recommending a product to a friend, but instead of doing it for free, you get paid every time someone takes your recommendation and makes a purchase.

Now that you understand what affiliate marketing is, let’s talk about how you can realistically make money from it.

On Day 1, you need clarity. Decide who you are selling to, and what are you selling?. Ask yourself: What problem am I solving? Who is my audience?

This mindset separates random link pushers from affiliates who actually make money. Your goal is to own a space and build trust around something you know and care about.

Choosing a niche is where that starts. If you get it wrong, nothing else matters.

Pick a space where your experience or interest gives you an edge, but make sure it is a niche in high demand. Choose a niche people are actively searching for and possibly spending on.

Successful affiliates often start with what they know. For example, affiliate marketers like Michelle Schroeder-Gardner started her affiliate journey with personal finance by sharing how she paid-off her student loans and recommending the tools she used.

John Chow, on the other hand, focused on building income through blogging, sharing what worked for him and promoting services he trusted. Because their story was authentic, their audience could feel that honesty and that’s what sold.

Action Step Today:

Pick one niche you care about. List three affiliate offers you could promote this week, and decide which platform you’ll use to promote your offers.

After you pick your niche and define your audience, the next step is finding an offer that’s easy to market. But first, you need to find a reputable platform that gives you access to affiliate products, high commission and makes it easy for signups.

Platforms like Mainstack, Amazon and Clickbank give you access to thousands of products that you can promote as an affiliate.

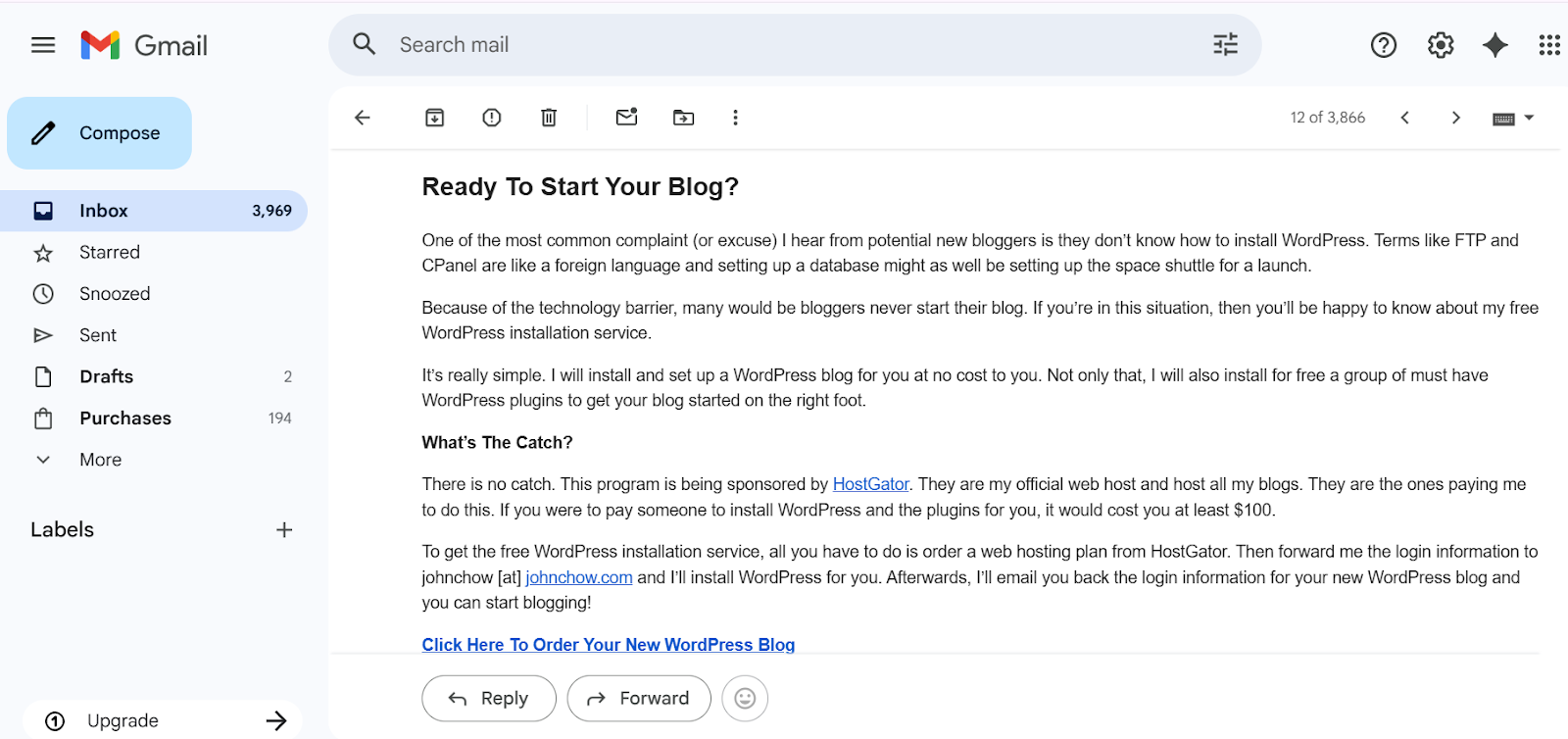

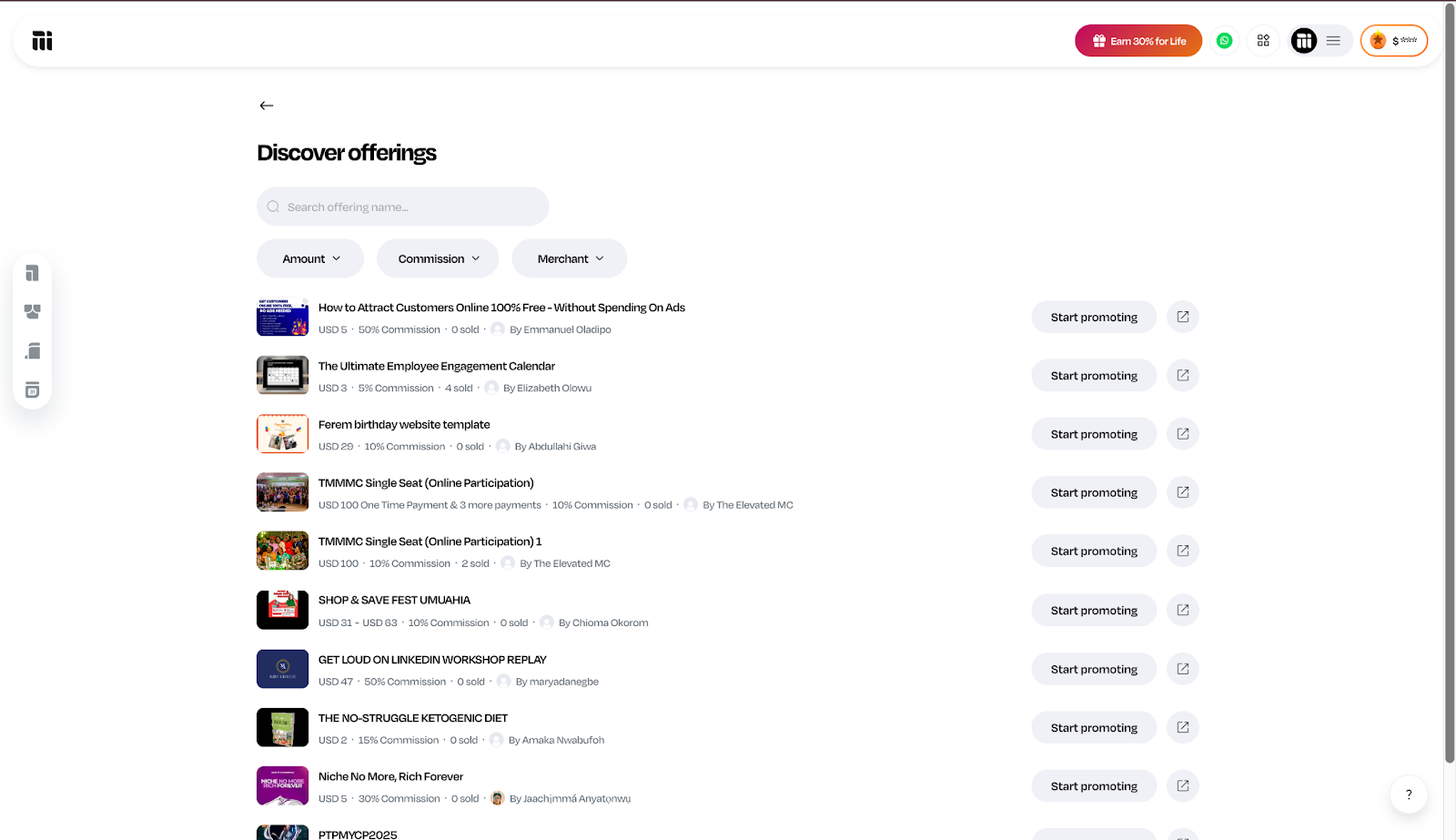

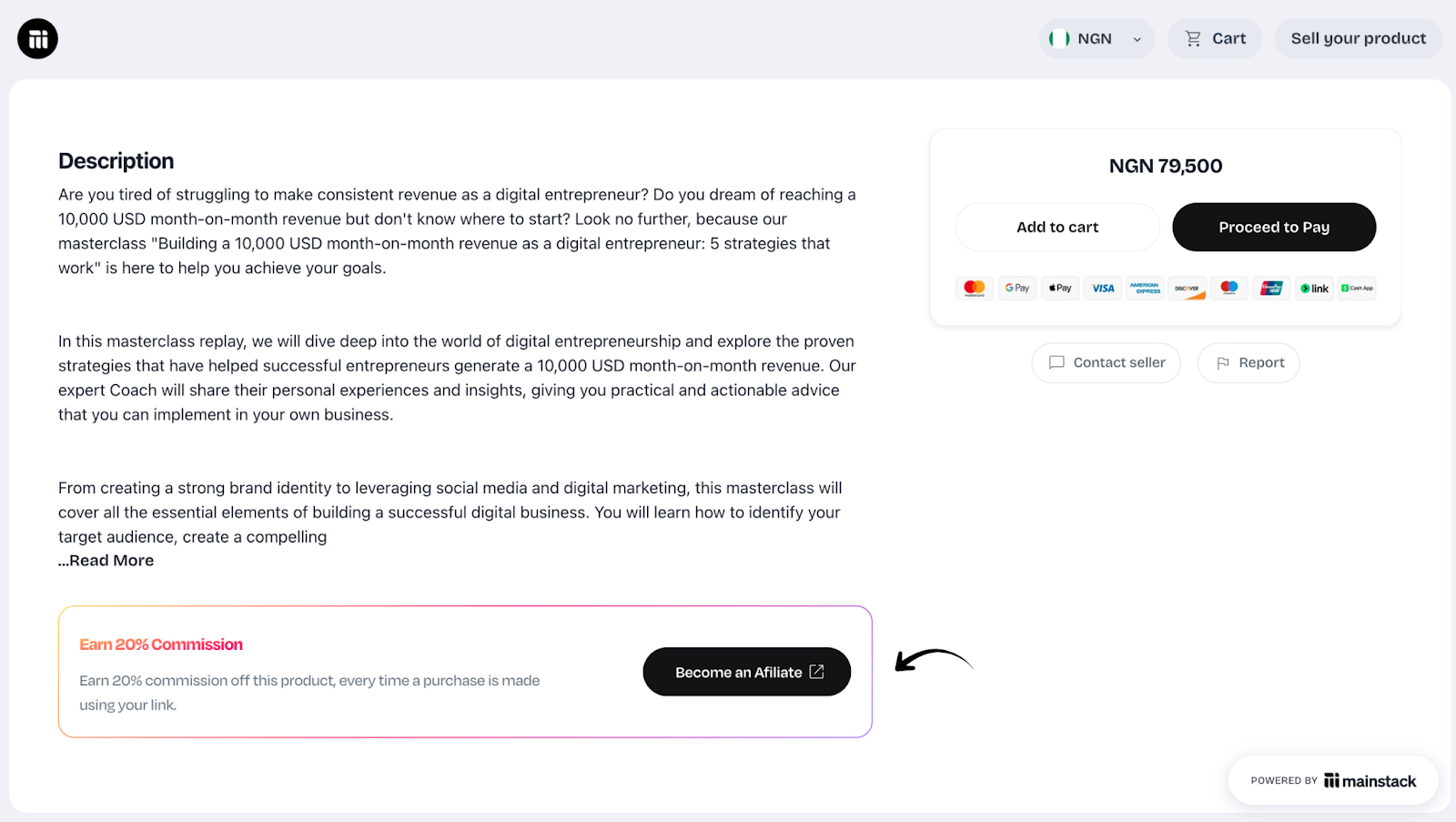

On Mainstack, you can find over 250+ affiliate offers, organize multiple links, and track all links from one dashboard without any extra tools.

Image Credit: Mainstack

What makes an affiliate offer worth your time? Here’s a quick checklist to help you choose the right product:

Now that you know what to look for, the next step is turning that knowledge into action.

Action Step:

Sign up on Mainstack today. Browse the affiliate marketplace, and pick 2–3 products you’d feel confident promoting this week.

Before promoting an affiliate link, you need reassurance that you’re picking the right one. Rather than promoting to a cold, unfamiliar audience, start with a warm market (e.g friends, peers, old classmates) as a testing ground for the products you intend to promote.

Share your affiliate link on iMessage, Instagram, TikTok, or Facebook Messenger and frame it like a tip, not a sales pitch.

Pay attention to their questions and hesitations. Use their feedback to sharpen your pitch, tweak your copy, and get ready for your cold-market launch.

The goal is to prove you can sell to people who already trust you before chasing strangers. Once you’ve validated this product with your circle, you’ll have a clearer sense of work.

Action Step Today:

Send your affiliate link to 10 people in your network and track clicks using your Mainstack link.

You don’t need a full website or a massive audience to start making money as an affiliate marketer. What you need is a credible home base where people can find your links and check your promos.

Your social channels (like TikTok, Pinterest, or Substack) are great for sharing links, but your platform is where they actually live. It could be a simple blog, a landing page, or even a Mainstack link-in-bio that keeps all your offers organized and trackable.

Image Credit: Mainstack

As you grow, start layering in structure: build a blog people can find, grow a community, or start a simple email list so you’re not stuck chasing algorithms.

Ana Savuica is a great example of this in action. She built her blog with one blog post about a $25 e-book she loved. Then added it to her sidebar, featured it in her welcome email, and created Pinterest graphics that kept sending traffic. That’s the kind of momentum you want.

Tracking isn’t optional; it’s your personal report card for every link you share. For every affiliate link, you need to know two things:

Platforms like Mainstack let you easily track affiliate links. On Mainstack, you can instantly see which links pull the most clicks and what kind of content your audience actually cares about.

Make it a habit to check both dashboards every week. Those insights show you what to double down on, what to tweak, and what to stop wasting time on.

Action Step:

Make it a habit to review your stats every week. That’s how you figure out what’s hitting, what needs tweaking, and what to stop wasting time on.

Day 1 is about starting small and moving fast. You won’t get rich overnight, but you can post something today, drive clicks, and earn your first commission.

Before you launch, sign up on Mainstack and set up your affiliate dashboard. It’s the easiest way to organize offers, showcase promotions, and track results

Your first $100 matters less than what you do next. Use that momentum to test, refine, and grow.

1. What is the first step to starting affiliate marketing as a beginner?

Pick a niche you already know or use daily. Choose one or two products that solve real problems for that audience, then create content around them.

2. Do I need a website to start affiliate marketing on Day 1?

No, you don’t. All you need is a credible space like a Mainstack Affiliate dashboard page to host your links. You can always build a website later as you grow.

3. How do I find affiliate products that sell?

Look for products with good reviews that align with your audience’s needs. Platforms like Mainstack’s affiliate marketplace let you browse verified offers before you decide what to promote.

4. What should I look for before choosing an affiliate program?

Check for fair commissions, strong brand reputation, and solid customer feedback. Also, look at the competition; if too many people are already promoting the same thing, it’s harder to stand out.

5. Can I do affiliate marketing on social media platforms like TikTok or Instagram?

Absolutely. Share real experiences through short videos or posts and use your Mainstack link to track clicks and conversions.

6. How do I track clicks and sales from my affiliate links?

You need an affiliate marketplace like Mainstack to track affiliate links. Use Mainstack for click analytics and audience insights, then check your affiliate platform for sales data. Together, they show what’s working.

7. How does Mainstack make affiliate marketing easier for beginners?

Mainstack takes the stress out of link management. It keeps everything in one place—links, clicks, and audience data. If you promote Mainstack marketplace products, you can see clicks and sales in the same dashboard.

8. How long does it take to make your first sale in affiliate marketing?

It depends. Some people make their first sale in a week, others in a month. Stay consistent, test different content, and use data to improve.

9. What mistakes should beginners avoid on their first day of affiliate marketing?

Don’t promote too many products or stuff you don’t believe in. Start with one or two solid offers and focus on helping your audience.

10. How much can a beginner realistically earn from affiliate marketing?

Most beginners earn small amounts at first. On average, $50 to $200 in the early stages. As you learn your audience and refine your strategy, earnings can grow into steady income.

The best tools for affiliate marketers in 2025 are changing the way people earn money online. Affiliate marketing has grown from simple link sharing into a smart, data-driven business. With the rise of AI, automation, and better analytics, marketers now have access to tools that make it much easier to promote products, track performance, and increase revenue.

Here’s a roundup of 15 of the best software programs for affiliate marketers across key categories. Read more to find tools to help you manage your daily tasks and help your business grow fast.

Affiliate marketing is one of the most effective ways to make money online, but it requires the right tools to be successful. These tools enable you to save time, work smarter, and earn more.

Here’s why they’re so important:

Affiliate marketing is easier (and more profitable) when you have the right tools to support your work. Here are eight types of tools every affiliate marketer should use in 2025:

Managing multiple affiliate links across platforms can get overwhelming fast. All in one affiliate tools help you organize, track, and optimize every link in one place so you can easily see what’s performing, update links quickly, and stay focused on what drives revenue.

.png)

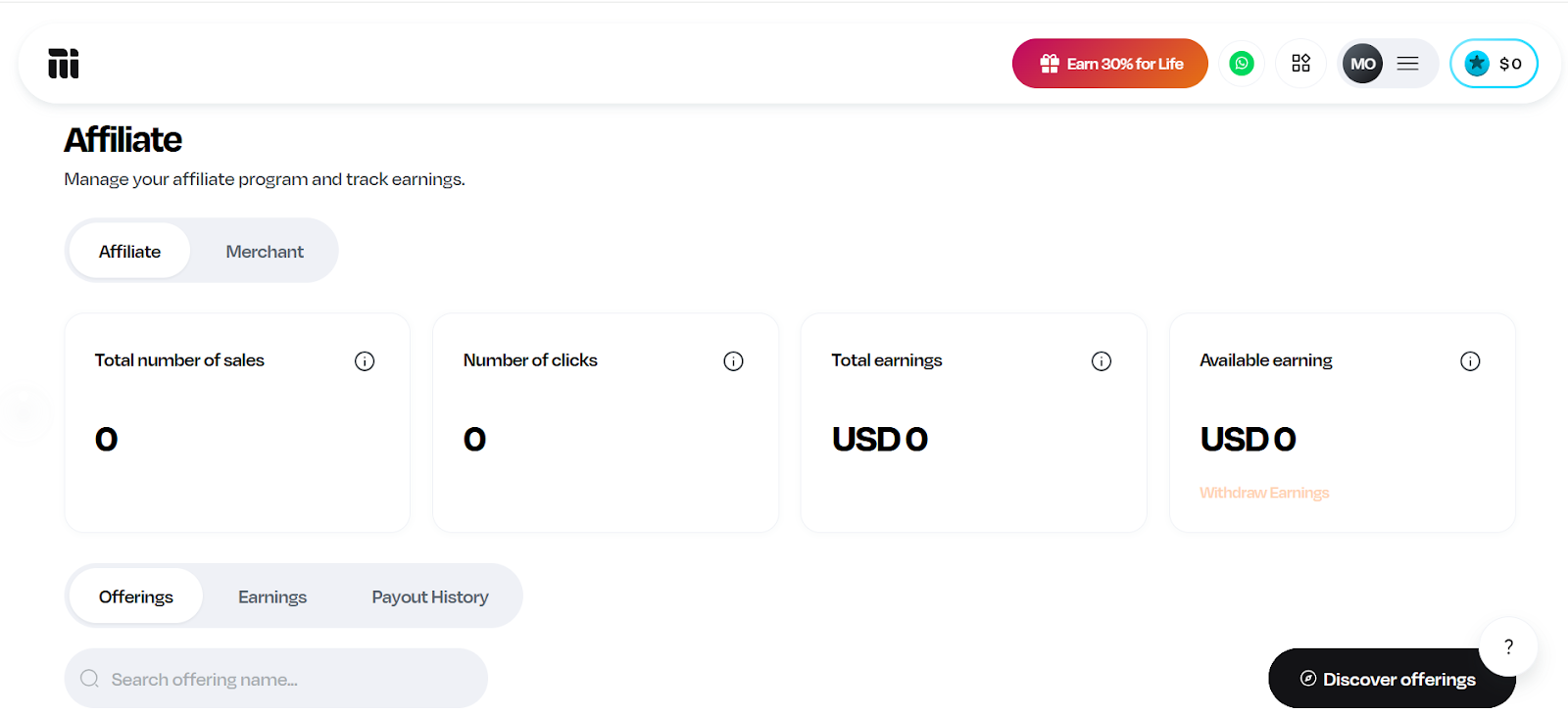

Mainstack gives affiliate marketers an all-in-one workspace to promote digital products, track performance, and manage payouts. The platform is built to support users across different countries, so creators and affiliates can work without worrying about currency limitations or regional restrictions.

Setting up your account is free, and once you’re in, you can immediately explore the digital products available for promotion in the affiliate marketplace. With Mainstack, you get your referral link along with a full workspace designed to help you manage your activity.

Your dashboard comes with built-in performance analytics, tools for shaping product pages, and other resources that make it easier for you to make sales, understand your results, and improve them.

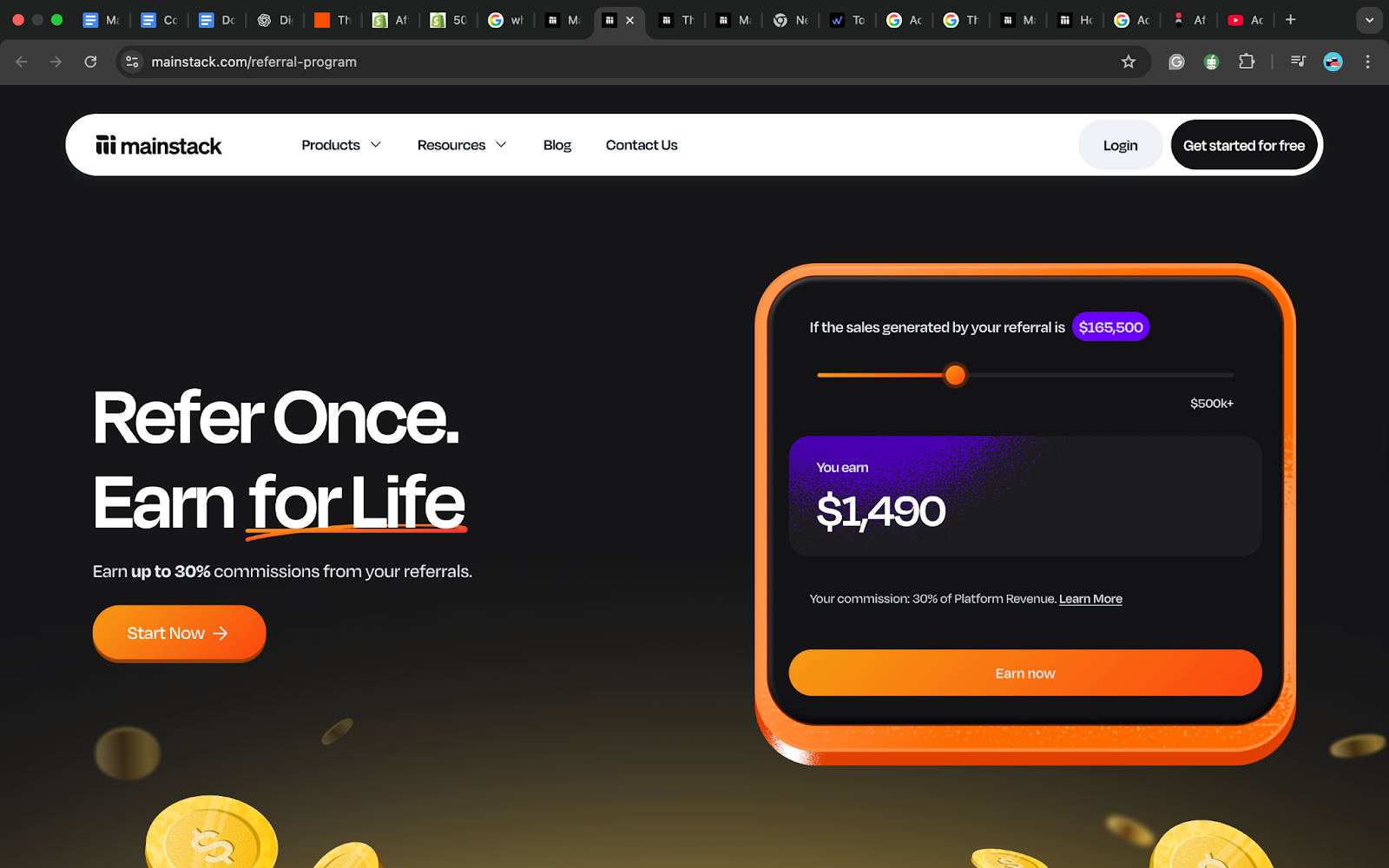

Mainstack also has a Refer & Earn Program where you earn 30% of Mainstack’s revenue every time someone you invite makes a sale. The best part is that your commission comes directly from Mainstack, not from the seller’s income.

Pricing: Mainstack is free to join for both affiliates and merchants. You earn based on performance, and payouts are made automatically. No hidden fees or subscriptions, just a simple 3% transaction fee for commerce features.

Mainstack helps you manage links, track sales, and earn commissions all in one place, making it the perfect all-in-one affiliate tool for 2025. Here’s how to join the Mainstack Affiliate Program.

Content creation tools enable you to design, write, and edit the content that draws people to your links. Even if you don't have design skills, these tools make it easy to create eye-catching posts, short videos, and graphics.

Canva makes it easy to design graphics, thumbnails, and marketing materials without needing design skills. It has a huge library of ready-made templates and a drag-and-drop tool that can help you design Instagram posts, blog banners, in minutes. Affiliates love Canva because it helps their content look professional and stand out on social media.

Pricing: The free version covers most needs, while the Pro plan adds premium templates and brand tools. Canva Pro costs $12.99 per month or $119.99 per year for one user.

CapCut is a beginner-friendly video editor that helps you create short, engaging videos for platforms like TikTok, YouTube, and Instagram even without video editing knowledge. It comes with free templates, effects, and AI editing tools to make your videos look polished.

For affiliate marketers, CapCut is great for creating tutorials or product reviews that include affiliate links. It’s as simple as recording a video on your phone, uploading it on CapCut, trimming out unnecessary parts and exporting a clean video ready to post in minutes.

Pricing: It’s free to start with, but the pro version starts from $9.99/month or $74.99/year. In some locations, its up to $19.99/month.

If you want to grow, you need to know your numbers. Analytics tools show where your traffic comes from, your highest selling product, best-performing posts and number of sales through your affiliate links. The more you know, the better you can improve your strategy.

Google Analytics is great for affiliates because it provides a comprehensive picture of what’s actually driving clicks, leads, and sales. The platform is designed to help you track traffic sources to see which platform (e.g Youtube, TikTok) sends the most traffic to your affiliate links.

Google analytics also gives you insights into your audience insight and their behavior flow. You can see who your audience is, how they move through your site, what pages convert best and where they drop off.

This helps affiliates understand what drives conversions and what needs improvement. It’s completely free and integrates easily with blogs and websites.

Pricing: Free to start with, but the paid plan (GA4 360) starts at approximately $50,000/year, depending on data volume and region.

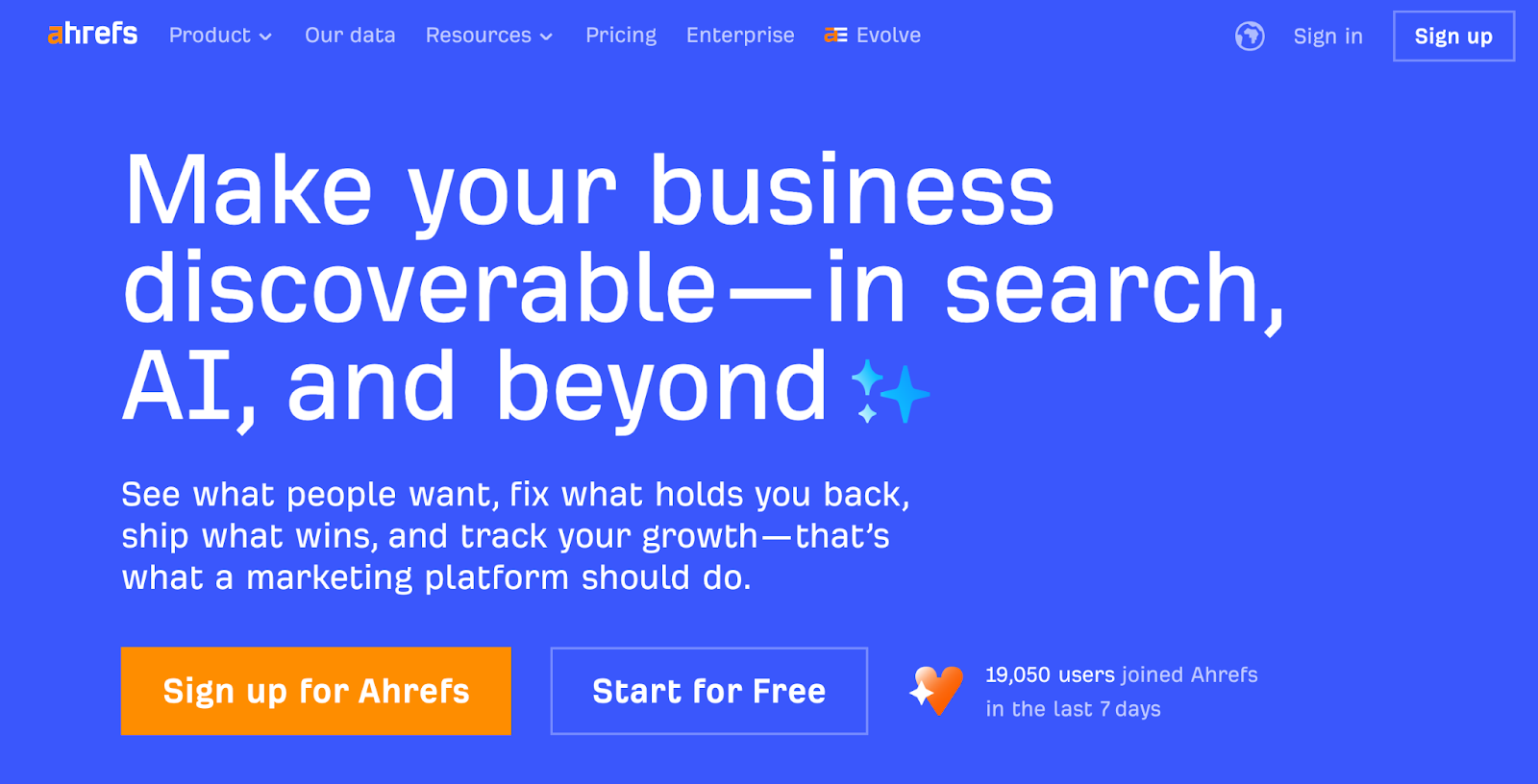

SEO and keyword research tools help your content rank higher by finding profitable keywords, revealing competitor insights, and tracking performance over time.

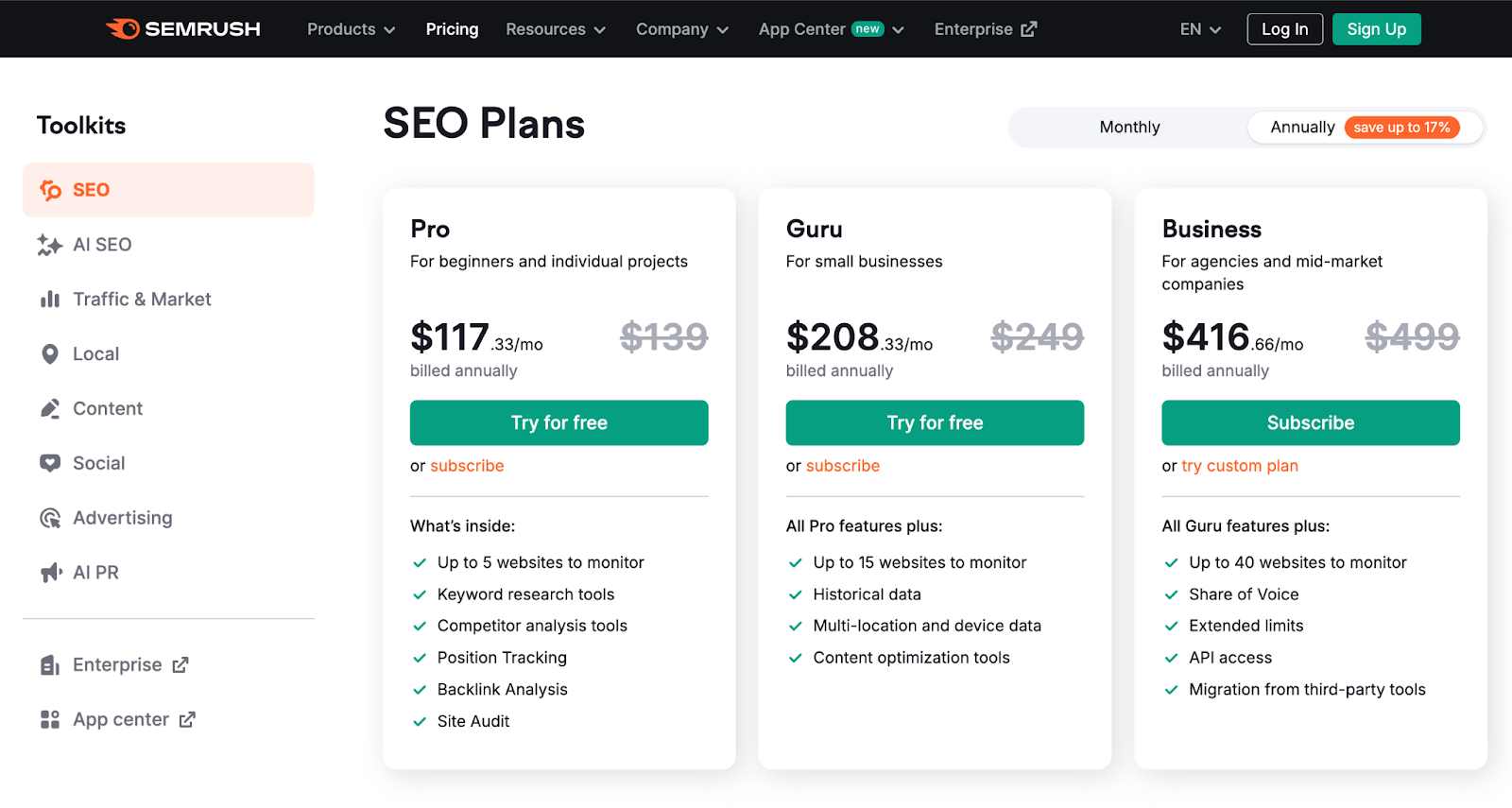

Platforms like Ahrefs, Ubersuggest, and Google Keyword Planner show what your audience is actually searching for, so you can create content that attracts the right traffic.

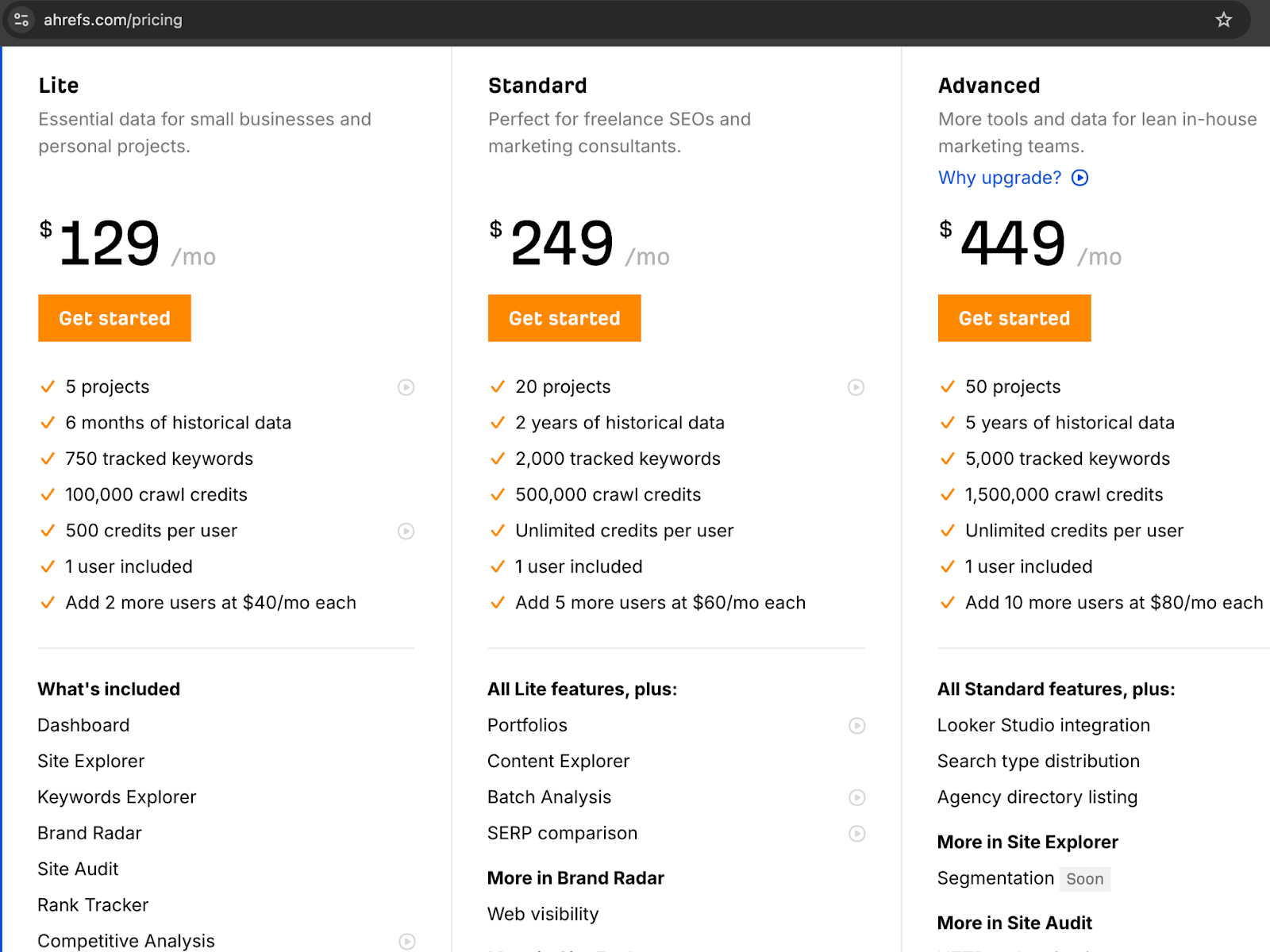

Ahrefs is one of the most trusted SEO tools for find keywords, analyze competitors, and track backlinks. It helps affiliate marketers discover what topics are ranking and where to focus their content. For example, if you promote productivity software, Ahrefs can show you which blog titles or keywords get the most clicks. It’s a paid tool, but the insights it provides are well worth the investment for serious marketers.

Pricing: Paid plans start at $129/month and can go up to $1,499/month for advanced and enterprise plans.

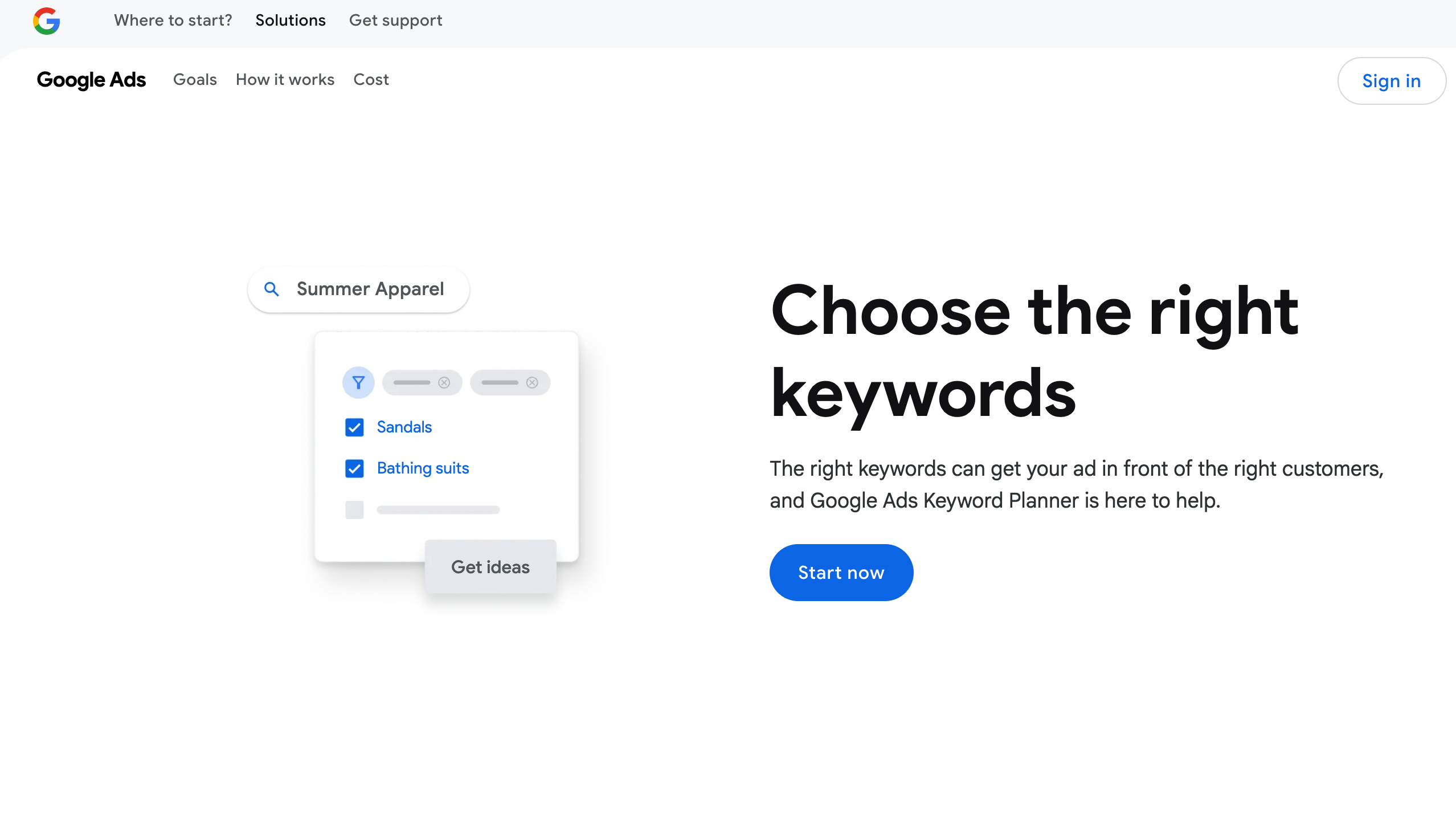

Like Ahrefs, Google Keyword Planner helps affiliates discover keywords their audience is searching for. Beyond that, you also get insight into questions people are asking, understand search trends, estimate traffic potential and refine targeting.

It’s perfect for creating SEO-friendly blog posts, YouTube titles, or ad campaigns. You can compare keyword competition, search volume, and trends to target the right audience. The best part? It’s free and pairs perfectly with other Google tools for research and planning.

Pricing: Using Google Keyword Planner is free, although you need a Google Ads account to access it. Usage is free, though data precision may increase if you run paid ads.

Building an email list is one of the smartest moves in affiliate marketing. It’s a simple way to build an audience, keep them engaged and drive repeat sales.

Email marketing tools like ConvertKit or Mailchimp help you send updates, product recommendations, and exclusive offers to your followers.

Kit helps affiliates grow and engage their audience through email. You can set up automated email campaigns, send newsletters, and add affiliate links naturally within your messages. It’s built for creators who want to turn followers into loyal buyers.

Pricing: There’s a free plan for beginners, with paid options for more advanced segmentation and automation, which starts at $15/month.

Mailchimp is one of the most popular email marketing tools for small businesses and affiliates. It offers templates, audience insights, and automation that make it easy to send professional campaigns. You can track open rates and clicks to see which products get the most attention.

Pricing: Mailchimp has a free plan for smaller lists and paid tiers for more advanced features that can go up to $350/month.

SMS/MMS add-ons, custom-coded templates, and priority support at top tier.

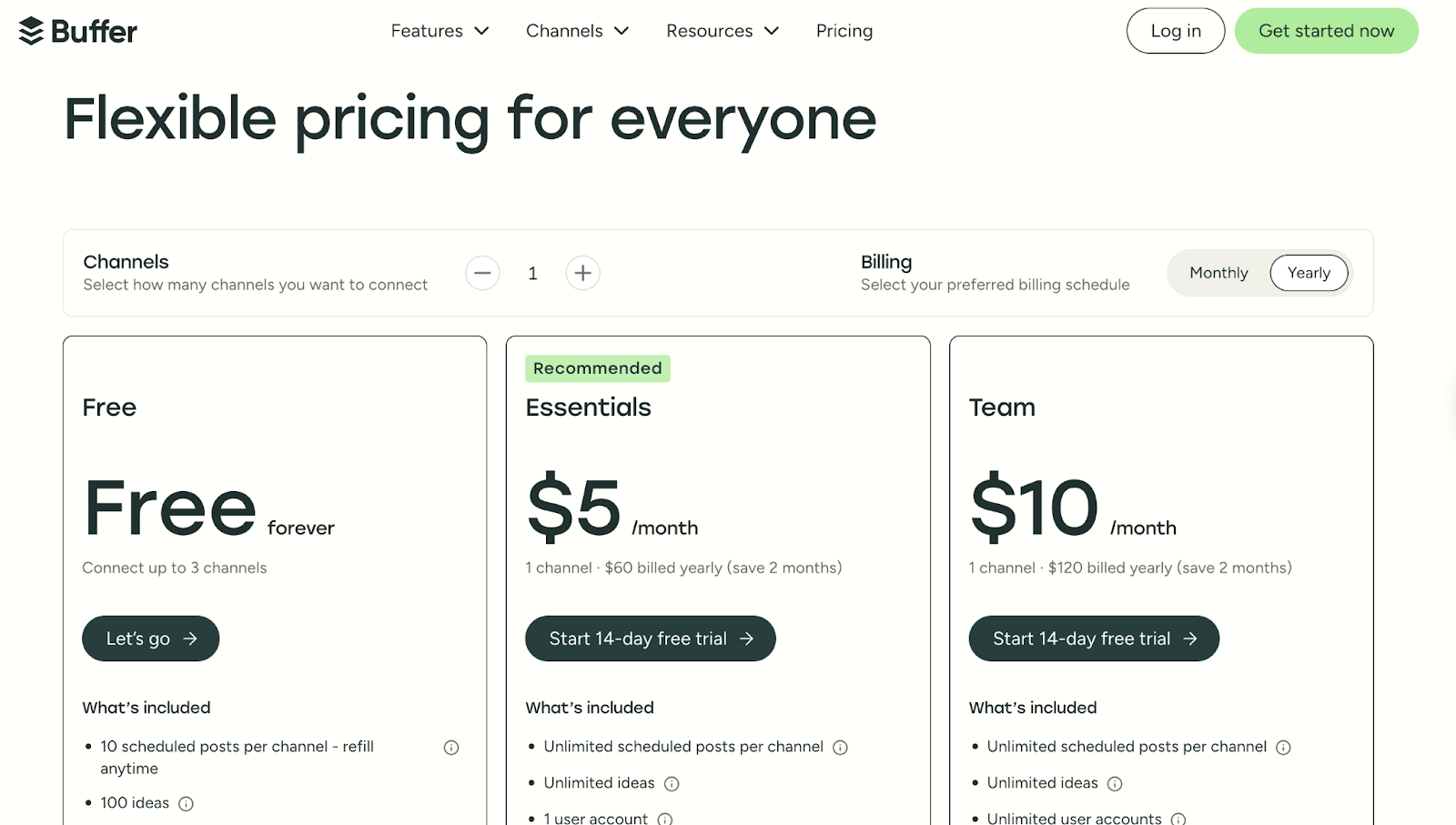

Posting regularly on multiple platforms can be stressful. Social media scheduling tools like Buffer, Later, or Meta Business Suite let you plan and schedule posts ahead of time. For example, you can set up a week’s worth of TikTok clips and Instagram posts that promote your affiliate products, and the tool will post them automatically.

Buffer helps you plan and schedule posts for platforms like Instagram, Facebook, LinkedIn, and X (Twitter). It’s perfect for affiliates who want to stay consistent without posting manually every day. Buffer also shows engagement data, helping you learn what type of content performs best.

Pricing: There’s a free plan for a few social channels, with paid upgrades for more accounts and detailed analytics.

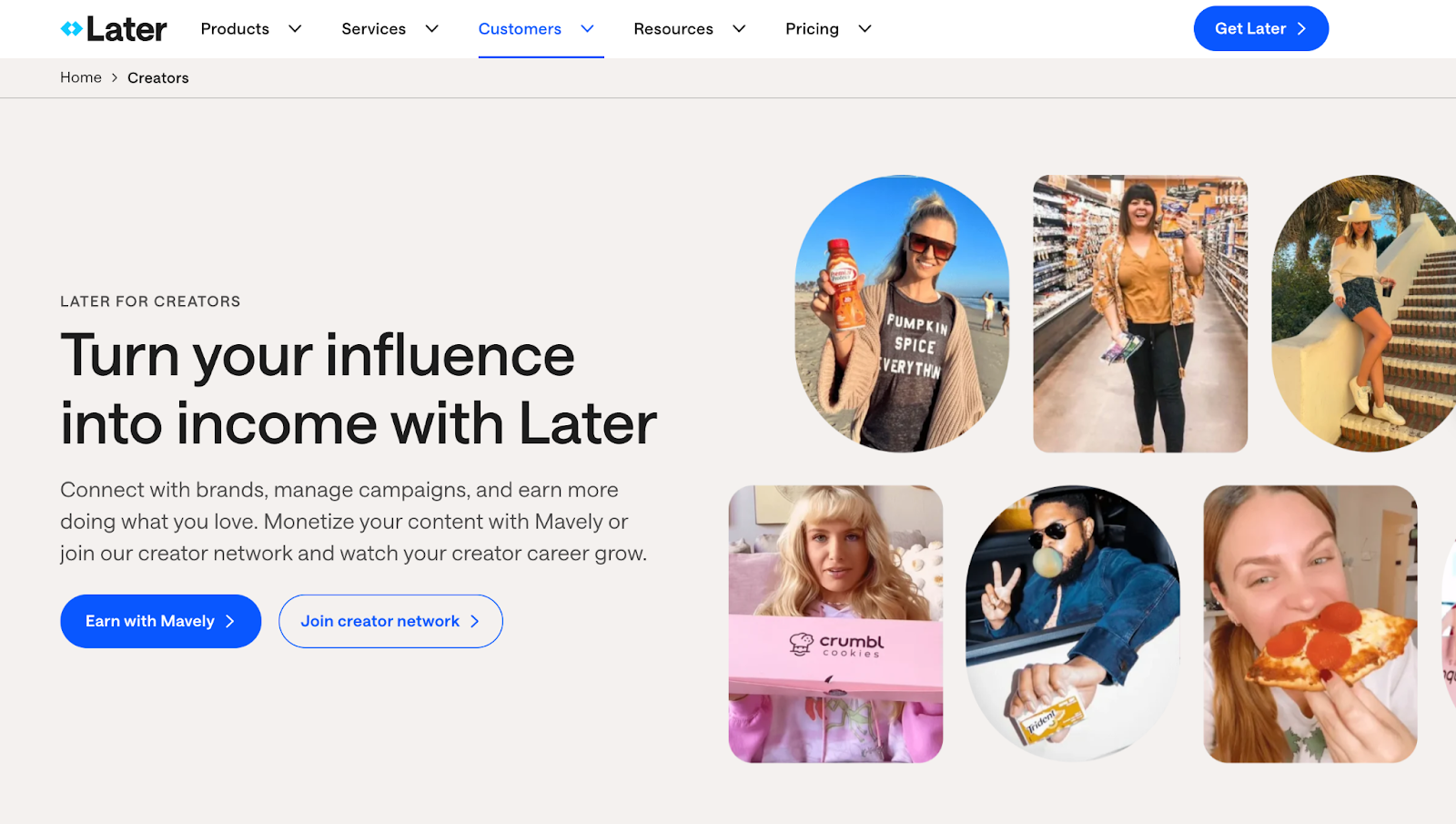

Later is a comprehensive influencer marketing and social media management platform that helps affiliates plan, schedule, and optimize their promotional content across platforms like Instagram, TikTok, and YouTube.

With its visual planner, affiliates can organize posts, maintain consistency, and use features like “Best Time to Post” to boost engagement. It also offers detailed analytics to track which content drives the most clicks and conversions, helping users refine their strategy over time.

Pricing: There’s a free plan that’s available for basic use. However, for more advanced plans, pricing starts at $18.75/month and can go up to $82.50/month. Pricing increases with add-ons like additional social sets, AI credits, users.

Staying organized is key as an affiliate marketer, especially if you’re working with a team or juggling multiple brands. Project management tools like Asana, Clickup and Trello, help you manage tasks, plan campaigns, and keep track of deadlines. You can even share projects with designers, writers, or editors to keep everything running smoothly.

Asana helps you organize your projects, set deadlines, and track tasks in one clean workspace. It’s ideal for affiliate marketers who juggle multiple campaigns or work with a small team. You can plan your content calendar, assign tasks, and use timeline views to stay on track.

Pricing: Asana’s free plan covers basic project management, while premium versions unlock advanced automation and reporting tools. The paid plans start at $10.99/month per user.

ClickUp combines task management, docs, chat, and goal tracking in one platform. Affiliates can use it to plan campaigns, store affiliate program details, and manage workflows. Its dashboards give a clear overview of everything from content deadlines to income goals.

Pricing: ClickUp provides a free version with extensive features, while paid plans beginning at $7 include more integrations and automation.

Creating content regularly can be tough, especially when you run out of ideas or worry about making mistakes. Writing assistants and idea tools like Grammarly and ChatGPT make the process easier and faster.

Grammarly helps you write clearly and confidently, ensuring your content is polished and professional. It checks your grammar, spelling, tone, and readability in real-time, making it perfect for refining blog posts, emails, and social captions. For affiliates, clear, error-free writing is essential because it builds trust with the audience and ultimately boosts conversions.

Pricing: The free plan includes basic corrections, while the Premium version adds advanced writing suggestions and starts at $12 per month.

Key Features:

ChatGPT is one of the most popular AI writing tools that helps affiliates brainstorm ideas, write product reviews, create social captions, or even outline YouTube scripts, essentially working as a powerful brainstorming partner. By assisting with writing blog posts and product descriptions and even generating SEO-optimized content, ChatGPT saves hours of time and helps affiliates stay consistent with their brand voice while managing multiple campaigns.

Pricing: A free version is accessible, along with a paid plan starting at $200 per month, which offers faster performance and more advanced tools.

When Grammarly and Chat GPT are used together, these tools help you write better, think faster, and produce more engaging content that drives clicks and conversions.

Ad Campaign Tools help affiliates create, manage, and optimize paid ads across platforms. They simplify targeting, tracking, and improving ROI. Options like AdEspresso, Google Ads Manager, and Semrush Ads Toolkit make it easy to design, test, and analyze campaigns for better conversions.

AdEspresso is an ad management tool that helps marketers and affiliates create, test, and optimize campaigns on Facebook, Instagram, and Google from one dashboard. Affiliates can use A/B testing to experiment with creatives, headlines, and audiences, while smart optimization tips and detailed analytics help improve campaign performance and conversions. It also integrates with other tools and CRMs for easier lead management.

Pricing: Pricing starts at $49 per month, and all plans include a 14-day free trial for new users.

When building your affiliate marketing strategy, start with essential tools for content creation, analytics, and link management. Choose tools based on your audience. YouTubers need video and SEO tools, bloggers need keyword research and writing assistants, and social media creators benefit from scheduling and engagement tools.

Use Mainstack as your foundation for link management and analytics. It organizes affiliate links, tracks clicks, and measures performance in one clean dashboard.

1. What tools do I need to start affiliate marketing?

You’ll need a link management tool like Mainstack, a content tool for creating posts (like Canva), and a traffic or analytics tool such as Google Analytics or Semrush.

2. What’s the best free tool for affiliate tracking?

Mainstack is a great free option. It helps you organize affiliate links, monitor clicks, and see performance insights in one place.

3. Can I start affiliate marketing without a website?

Yes. You can use platforms like TikTok, YouTube, or Instagram and share your affiliate links through a Mainstack link-in-bio or custom storefront page.

4. What’s a good tool for promoting affiliate links on social media?

Buffer and Later help you schedule and manage affiliate content across platforms like Instagram, X (Twitter), and TikTok.

5. How do I find good affiliate products or programs?

You can discover affiliate programs through Mainstack, Amazon Associates, ClickBank, or Impact. Always check for reliable payouts and product quality.

Let’s be honest, everyone wants to make money while they sleep. And in 2025, affiliate marketing makes that dream more realistic than ever. If you’ve been asking yourself how to start affiliate marketing in 2025, this guide is your blueprint.

Most people start affiliate marketing as a side hustle and eventually grow it into a thriving business. The best part? It requires little to no startup capital, just your commitment, consistency, and the right product with an irresistible offer.

Whether you’re a content creator, coach, or complete beginner, we’ll show you how to pick a niche, find the best programs, and build a system that earns money even when you’re offline.

Affiliate marketing is a performance-based marketing model where an individual promotes another person's product or services and earns a commission for each sale made through their unique affiliate link.

Affiliate marketing operates on a simple but powerful ecosystem. It involves four main players: the merchant, the affiliate, the consumer, and the network. Each plays a key role in turning a simple recommendation into real income.

A perfect example includes people like Elizabeth Olowu and The Elevated MC who use Mainstack’s referral program to push their products.

However, not all companies rely on external networks. Mainstack, for example, runs its own in-house affiliate system. This means affiliates can sign up directly on Mainstack, generate referral links, and track performance from their dashboards. Thus, no third-party platform is needed.

Affiliate marketing has transformed beyond simple website links. Now, affiliates leverage blogs, YouTube, TikTok, Instagram, and emails to promote products and earn commissions. Bloggers may compare digital tools with affiliate links, YouTubers create product tutorials with links in descriptions, and TikTok creators share engaging product demos. Email marketers also provide personalized recommendations, converting loyal subscribers into repeat customers.

If you're wondering if affiliate marketing is still profitable in 2025, the answer is yes, but it's evolved.

With the rise of the creator and influencer economy, anyone can now make money by promoting products they genuinely believe in. Whether you’re a YouTuber, blogger, or TikTok creator, it’s profitable because it’s built around freedom, creativity, and strategy. Here’s why it works so well:

Starting affiliate marketing in 2025 is easier than you think. You don’t need a large audience or costly tools—just strategy and consistency. This section covers how to set up your affiliate business, pick the right products, and earn commissions sustainably.

Choosing the right niche is key to success in affiliate marketing. It defines your audience, products, and earning potential. The best niche balances demand, relevance, and personal interest.

To pick a niche, start by focusing on topics you care about. Is it tech, lifestyle, beauty, or finance? Choose a product you believe in so your content feels authentic and builds trust. But passion alone isn’t enough. Your niche also needs to be in high demand and solve a real problem.

For example, a niche like “how to become a ghostwriter” works better because it targets people who already know what they want and are actively looking for tools, courses, or platforms to help them get started. On the other hand, a broad topic like “how to make money” might be too vague. It attracts a wide audience but rarely converts because most people are just browsing for ideas, not ready to buy.

The key is to find the sweet spot: something you're interested in, that people are looking for, and that has affiliate programs with good commissions.

Once you’ve defined that, everything else; your content, audience, and income, starts to fall into place.

After choosing your niche, the next step is finding the right affiliate programs to join. Not all programs are created equal, so it’s important to look for ones that align with your audience and offer real earning potential. Look for programs with good commissions, reliable tracking, timely payouts, and solid reputations.

Begin by looking at what successful creators in your niche are promoting; this is often an indicator of what works well. Then, compare the program structures. Check for details like:

For beginners, Mainstack offers an easy affiliate setup for creators selling digital products or services. You can generate links, track clicks, and earn up to 30% commission on each sale, which is paid monthly.

Other strong options include Amazon Associates for physical products, ClickBank for digital items, and Impact for big brands and SaaS tools.

Choose programs that align with your content and audience. Promoting products you trust builds credibility and trust drives sales.

After you've chosen your affiliate programs, the next step is to decide where you'll promote them. The best platform is determined by your strengths.

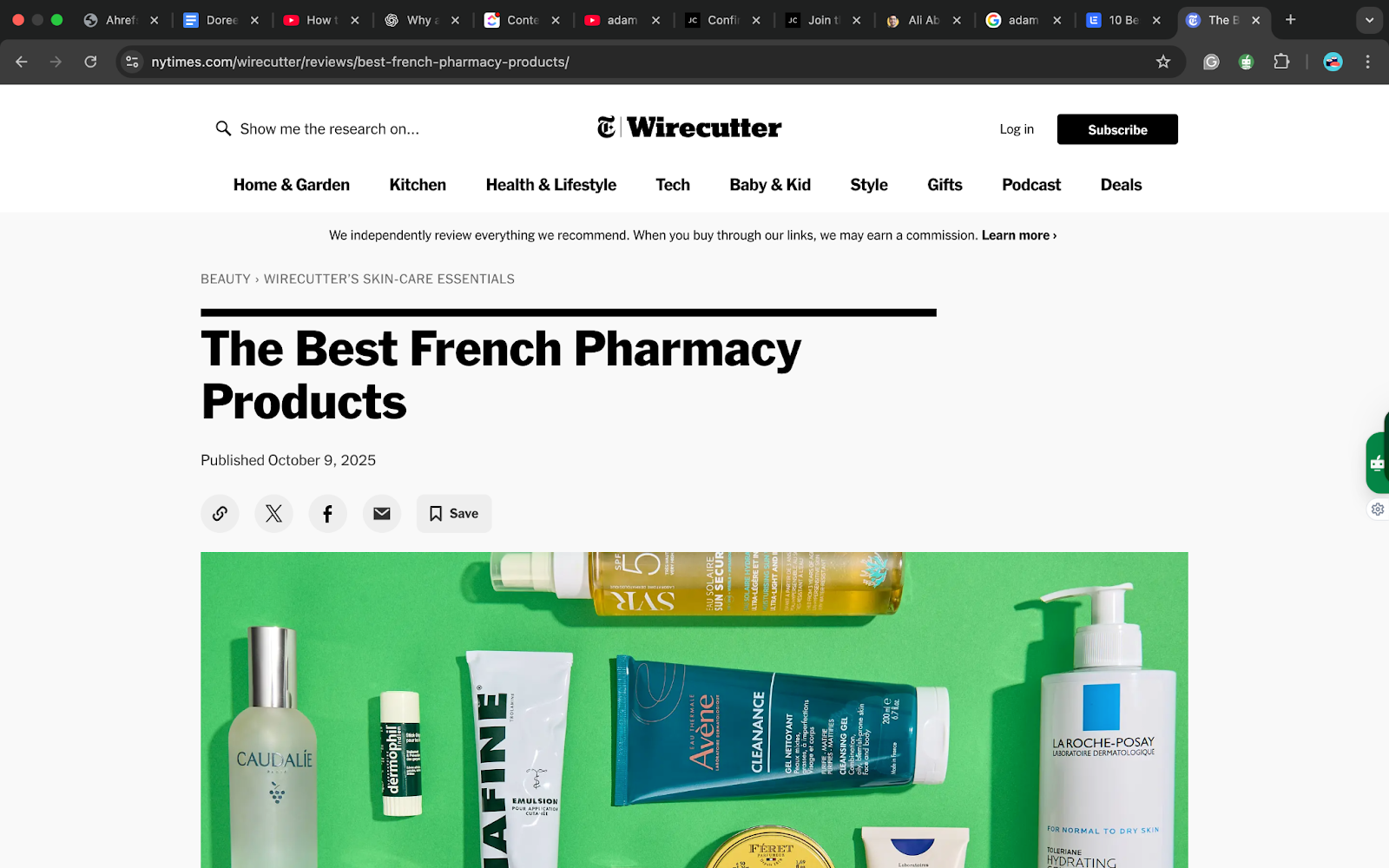

If you enjoy writing and sharing detailed insights, a blog or website is an excellent place to start. For example, successful affiliate marketers, like Wirecutter, use SEO-driven articles to review products, compare tools, and rank on Google for high-converting keywords.

This approach builds long-term visibility and passive traffic.

If you’re more comfortable on camera, YouTube is a great platform. Creators like Marques Brownlee (MKBHD) include affiliate links to products they review. Video content is great because it helps viewers see the product in action before making a decision.

For those who prefer short-form content, TikTok and Instagram are ideal for quick, engaging product demos or tips. Influencers like Erika Kullberg and Kat Norton (Miss Excel) utilize short videos to showcase products while subtly including affiliate links in captions or bios.

And if you already have an email list, newsletters can be an effective channel for affiliate promotions. Creators such as Ali Abdaal and James Clear use email to recommend products, courses, or tools they personally trust, driving high engagement and repeat clicks.

To make managing your links easier, Mainstack offers an all-in-one solution. You can create a personal link-in-bio page or digital storefront that houses all your affiliate links, products, and offers in one place.

Even better, it provides real-time analytics to track clicks and conversions, helping you see which platforms or products perform best.

Learn more: How to start Affiliate marketing on Mainstack

After choosing your niche and platform, decide which products to promote. The success of your affiliate marketing journey depends on what product you sell and how well it matches your audience’s needs.

Focus on three important factors: price, quality, and reputation. Products with favorable customer feedback and visible demand are more likely to convert. It's not just about making big commissions; it's about promoting something people will actually buy and appreciate you for recommending.

For beginners, avoid promoting too many products at once. Start small with two or three products that fit your niche, then expand as you grow. For example, designers can promote tools like Canva or Adobe Express that solve real problems.

Be authentic. Promote products you use or truly believe in. The most successful affiliates are not pushy salespeople; rather, they are helpful guides who provide real value.

Over time, you can test new offers or bundles, and consider creating your own digital products to scale further.

The success of affiliate marketing lies in creating content that informs, educates, or solves real problems. Audiences don’t respond to random product links; they want useful insights and genuine experiences.

Create content that builds trust and positions you as an authority in your niche. Some effective formats include:

Use SEO to make your content discoverable and storytelling to make it relatable. Combine this with social media content for faster growth.

Ensure you publish consistently to keep your audience interested. The more value you deliver, the more trust you earn, and that’s what drives affiliate conversions.

Creating exceptional content is half the job; the next step is driving traffic to it. Without it, even top-notch affiliate content won’t convert.

There are both free and paid methods to drive traffic, and most beginners start with the free options before scaling up.

Master free strategies first to learn what works. For example, you can optimize for SEO to rank on Google or YouTube, share short tutorials or demos on Pinterest or TikTok, and use email marketing to send tips and recommendations to subscribers.

Once you gain traction, scale with paid promotion for faster growth. Test paid options like Instagram, Facebook, or Google Ads to reach targeted audiences, or collaborate with influencers for wider exposure.

Tracking performance separates hobbyists from serious affiliate marketers. After publishing your content, monitor clicks, conversions, and earnings. Ideally, your affiliate platform should have a dashboard to help you monitor this. You can also use tools like Google Analytics to track content and channels that drive results.

For instance, a “Top 10 Tools for Remote Work” post might outperform tutorials, or TikTok videos might convert better than emails. Use this data to refine what works; adjust link placement, update calls to action, or test new products.

Treat affiliate marketing as an ongoing experiment. Review data regularly, optimize top links, and refine strategy to increase conversions and income over time.

Many beginners rush into affiliate marketing without a strategy. One common mistake is promoting too many products at once, which makes content feel cluttered and less trustworthy.

Neglecting content quality also hurts sales; the best products won’t sell if your message isn’t valuable or actionable. Always disclose affiliate links to stay credible, and be patient; consistent effort is what leads to steady income.

Affiliate marketing isn’t about luck. It requires strategy, perseverance, and the use of the appropriate tools. The beauty of it lies in its flexibility: you can build a business from your laptop, promote products you already love, and earn while you sleep.

Every post, video, or email you share is an opportunity to grow your influence and your income.

If you want an easy way to organize your affiliate links, host products, and track clicks in one place, Mainstack gives you the structure you need to turn your ideas into income.

As more businesses find ways to thrive in a crowded market, the best digital marketing tools in 2025 provide smarter, faster, and more efficient methods to reach customers.

What began as manual tracking and guesswork has now evolved into powerful systems that streamline every stage of marketing. This evolution enables startups and established brands to compete and grow in meaningful ways.

This guide will give a complete, step-by-step plan and downloadable checklist to help you choose the right tools, set up effective strategies, and track your progress with ease.

Digital marketing tools are online platforms, apps, or software that help businesses plan, manage, and measure their marketing strategies across channels like social media, email, SEO, content, and advertising to boost engagement, generate leads, and increase sales.

Digital marketing tools make life easier by automating repetitive tasks such as post scheduling, email distribution, and campaign tracking. Instead of getting overwhelmed with manual tasks, you have more time to focus on the creative aspects of growing your business.

They also provide real-time feedback on what works and what doesn't. With clear data on customer behavior and campaign performance, it's much easier to make better decisions that are impactful to your business.

With how fast the business world is moving, the right tools can help your brand stand out. Whether it's personalizing your messages or reaching the right audience faster, they give you an advantage over businesses that still rely on traditional methods.

And the best part? They’re often far more affordable than traditional marketing. Small businesses can now benefit from effective tools without breaking the bank, making online growth more accessible than ever. Traditional marketing, on the other hand, usually involves methods like print ads, billboards, TV, or radio spots, all of which are costly and difficult to track.

For example, a small bakery wanting to advertise through a newspaper ad might spend hundreds of dollars for just a single placement, with no clear way to measure how many people actually came in because of it. With digital marketing tools, that same bakery could run targeted social media ads for a fraction of the price, track clicks and conversions in real time, and adjust the campaign instantly to get better results.

With many options available, the right tool depends on your marketing goals. Here’s a list of top digital marketing tools by category to help you find what fits your business.

For creators who want everything in one place, all-in-one tools make it easier to manage content, grow an audience, and track performance without juggling multiple platforms.

Mainstack is an all-in-one platform for creators, entrepreneurs, and small businesses to build landing pages, showcase products, and sell directly to their audience. It enables you to transform your online presence into a monetizable hub without the need for multiple tools, making it ideal for anyone who wants to manage everything in one place.

Some of its standout features include customizable landing pages, a built-in storefront for both digital and physical products, and an analytics dashboard that tracks audience engagement. It also comes with payment integrations for seamless sales and a simple link-in-bio option that works perfectly across social platforms.

Mainstack offers a free plan with core features, making it accessible to beginners. The platform supports flexible payment options, including one-time fees, subscriptions, pay-what-you-want models, and even crypto payments in over 135 currencies. The icing of the cake is that Mainstack doesn’t charge monthly fees. It only collects a small 3% platform fee when you earn, so you keep more of your revenue.

SEO and content marketing tools help businesses attract the right audience and rank higher on search engines. They simplify keyword research, on-page optimization, and content planning to improve results.

Ahrefs is a leading SEO platform for keyword research, backlink analysis, and competitor insights. Its free tools let you generate up to 150 keyword ideas, check difficulty, and track rankings. This makes it ideal for small businesses or individuals starting out.

Ahrefs is known for its accurate data and keyword precision, which gives marketers better keywords to target. The downside, however, is that you need a paid plan to unlock advanced features like detailed backlink reports or larger keyword volumes, which can be pricey.

Regardless, the upgrade unlocks one of the most powerful SEO suites on the market.

Pricing: Free; paid plans start at $129/month.

If you want to carry out a detailed competitor analysis, then Semrush is the best tool for that. It gives you a clear picture of who your competitors are, which keywords they rank for, where their traffic comes from, and what ads they run.

This makes it a powerful tool to find strategy gaps and new growth opportunities.

While using Semrush is great, its wide range of insights can be overwhelming for beginners. Also, pricing may be high for small teams. However, for businesses ready to take SEO and digital marketing seriously, Semrush provides exceptional value.

Pricing: Free trial available; paid plans start at $139/month.

Google Keyword Planner is a solid free tool for basic keyword research. Originally built for Google Ads, it lets you find keyword ideas, search volumes, and competition levels using data directly from Google. It’s less detailed than paid tools like Ahrefs or Semrush but great for getting started on a budget.

Managing multiple social accounts is time-consuming, but social media tools help by scheduling posts, tracking performance, and boosting engagement. Here’s how the top options compare:

Buffer is a simple social media tool for scheduling and publishing posts across Facebook, Instagram, LinkedIn, and X (Twitter). Its clean interface makes it ideal for small businesses and creators who want an easy way to stay consistent.

While Buffer’s free and lower-tier plans offer only basic analytics, its paid plans include more in-depth performance insights. Where it really shines, though, is in reliable, straightforward scheduling that keeps your content organized and on time.

Pricing: Free plan available; paid plans start at $5/month per channel.

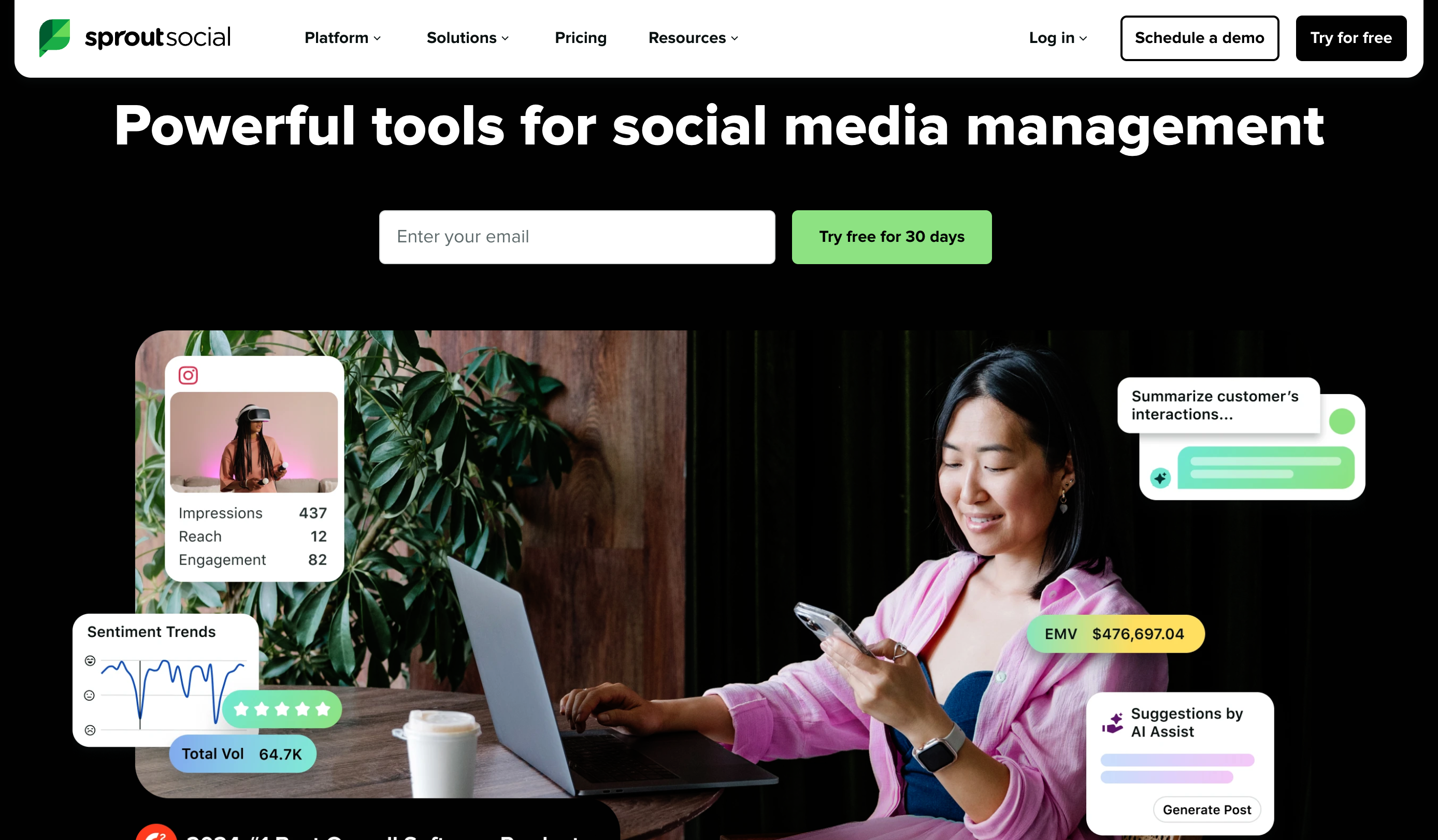

Sprout Social is a powerful social media tool with advanced analytics, detailed reporting, and engagement features. It’s ideal for teams and agencies that want to track campaign performance and make data-driven decisions.

What makes Sprout Social stand out is the quality of its insights. You can track audience growth, engagement trends, and campaign performance in detail, all while collaborating with your team on one platform. The downside of using Sprout Social is that it comes at a higher cost, which may be challenging for small businesses.

Pricing: Free trial available; paid plans start at $249/month.

If you’re not ready to invest in a paid scheduling tool, Meta Business Suite is a great free option. Designed for Facebook and Instagram, it lets you plan and schedule posts, reply to messages, and check performance insights, all from one dashboard.

While it’s limited to Meta platforms, it’s surprisingly effective for small businesses, creators, and entrepreneurs who mainly use Facebook and Instagram to reach their audience. You can manage both accounts in one place without needing extra tools, making it a simple, no-cost way to stay consistent online.

Email marketing tools help businesses send campaigns, automate follow-ups, segment audiences, and personalize content. The right choice depends on your audience size and goals.

Mailchimp is known for its ease of use and range of features, from drag-and-drop email builders to automation workflows and audience segmentation. It’s great for managing campaigns in one place: from design to copy to planning to tracking analytics.

The free plan is generous, but pricing scales as your subscriber list grows.

Pricing: Free plan available; paid plans start at $13/month.

.png)

One advantage of using Kit is how it supports audience growth and monetization. You can tag and organize subscribers based on their actions, build custom sequences, and nurture leads without needing advanced technical skills.

While its email templates are minimal, it offers an efficient system for growing and monetizing your audience.

Pricing: Free plan available for up to 1,000 subscribers; paid plans start at $15/month.

MailerLite is a lightweight, budget-friendly option that still covers essential features like automation, landing pages, and sign-up forms. It’s particularly appealing to small businesses or beginners who want a straightforward way to run email campaigns without complexity.

Pricing: Free plan available for up to 500 subscribers; paid plans start at $9/month.

Analytics tools help businesses understand how campaigns perform, how users behave on websites or apps, and where to improve to maximize ROI. Here are some analytics tools:

Google Analytics 4 (GA4) is the go-to tool for tracking website traffic, conversions, and user behavior. It helps you understand where visitors are coming from, how they interact with your content, and which channels drive the most revenue. While it’s powerful, the setup can feel complex for beginners.

Pricing: Free.

Hotjar takes analytics further by providing heatmaps, session recordings, and user feedback tools. Instead of just numbers, you can see exactly how people click, scroll, and interact with your website, making it easier to spot usability issues and optimize conversions.

Pricing: Free plan available; paid plans start at $32/month.

AI tools are transforming digital marketing by helping businesses create content faster, personalize messaging, and make smarter predictions about customer behavior.

Jasper AI specializes in generating blog posts, ad copy, and marketing emails using AI. It’s trained on marketing frameworks and tones, making it a solid choice for brands that want polished, conversion-focused writing at scale.

Pricing: Plans start at $59/month.

Great marketing requires visuals that capture attention, and design tools make it easy for anyone even without design skills to create professional-looking graphics and campaigns.

Canva is one of the most popular design tools, offering templates for social media, presentations, ads, and more. It is so beginner-friendly that anyone could work around the already existing templates and create a masterpiece. Its drag-and-drop interface makes it simple for non-designers, and the free version is robust enough for most small business needs.

Pricing: Free plan available; Canva Pro starts at $12.99/month.

Figma is a design tool built for collaboration. Teams can create, edit, and comment on designs in real time, making it perfect for marketers working with designers or agencies. It’s especially useful for UI/UX projects and campaign mockups.

Pricing: Free plan available; paid plans start at $5/month depending on the collab, dev or dull seat..

Running paid ad campaigns requires precise targeting, careful budgeting, and clear tracking to make sure every dollar counts. Paid Ads and PPC tools simplify campaign management, measure ROI, and help businesses reach the right audiences faster.

Google Ads is the most widely used platform for pay-per-click advertising. It allows businesses to bid on keywords and display ads at the top of search results, reaching customers at the exact moment they’re searching for solutions. Its strength is intent-driven traffic, though competition for popular keywords can make costs high.

Pricing: Pay-per-click model, no fixed monthly fee.

Pricing: Flexible budget; pay-per-click or impression.

With so many moving parts in digital marketing, project management tools help teams stay organized, collaborate smoothly, and ensure campaigns launch on time.

Trello uses boards, lists, and cards to organize tasks in a highly visual way. It’s simple, flexible, and perfect for small teams that want to manage campaigns, brainstorm ideas, or track workflows without overwhelming features.

Pricing: Free plan is available; paid plans start at $5/month per user.

Asana is more than just a to-do list. It’s a collaboration tool that helps teams stay organized and finish big projects on time. You can use it to see how tasks connect (called dependencies), view everything on a clear timeline, and start new projects quickly with ready-made templates. This makes it perfect for marketing or creative teams that handle tons of campaigns and deadlines at once.

Asana integrates with more than 200 applications, including Google Workspace, Slack, and Microsoft Teams, eliminating the need to switch between different programs.

You can add custom fields to track what matters most to your team, and use workload tools to see who’s busy and who has time to help. Automation saves time by handling small, repetitive jobs automatically. Plus, Asana now includes smart AI helpers that can spot delays, suggest next steps, and keep projects running smoothly.

Pricing: Free plan available; paid plans start at $10.99/month per user.

Using digital marketing tools effectively goes beyond just signing up. To maximize results, review analytics regularly and adjust strategies based on real data. Automate repetitive tasks like emails, scheduling, and reporting to free up more time for creativity and strategy.

Combine tools for a full stack. For example, you can pair analytics with email automation or project management with social scheduling to create a more powerful marketing system.

At the end of the day, marketing tools are there to make life easier, not harder. Start small; choose two or three that address your biggest needs, like audience growth, time savings, or better content, and expand as you grow.

Looking for an all-in-one digital marketing solution built for creators? Mainstack lets you host digital products, track analytics, and manage engagement, all from one simple dashboard.

Every day, people are monetising at scale and generating revenue globally- not because they launched a business, but because they started sharing links. While you’re still planning your next move, others are already earning from products that aren’t even theirs.

The window is wide open right now. The first set of affiliates is getting in early, securing the audience, and grabbing attention that’ll look unreal in a few weeks. You can either watch the numbers grow or be the one getting paid from them.

You already know how powerful Mainstack is - now imagine earning every time someone buys from it. No products to create. No barriers. Just your voice, your reach, and a link that makes you money.

Here’s how to start:

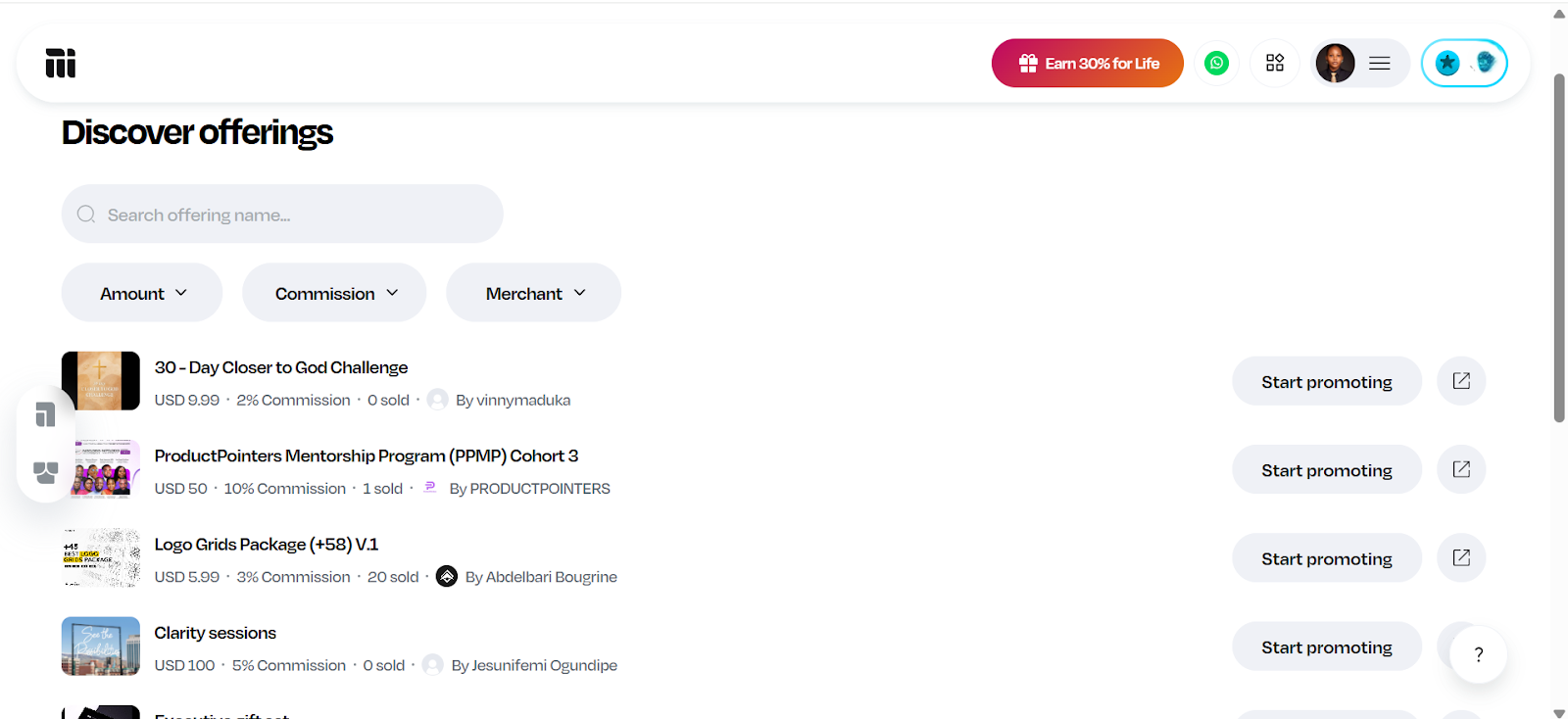

From your Mainstack dashboard, click your display picture and select Affiliate Program.

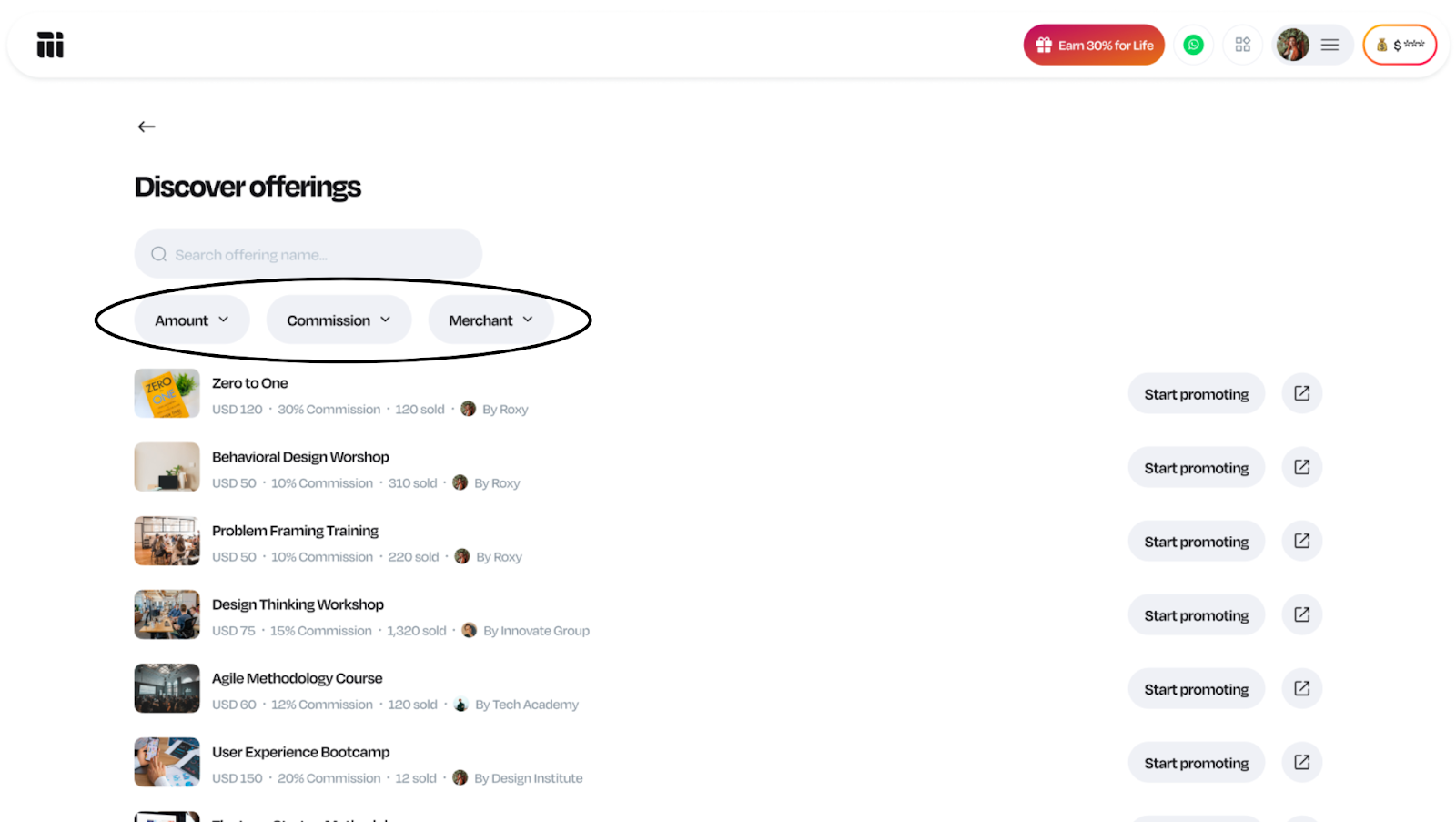

On the affiliate dashboard, click the “Discover Offerings” button. You’ll see a list of products from different merchants that you can promote to earn commissions.

Browse through the available products. You can filter them by amount, commission rate, or merchant.

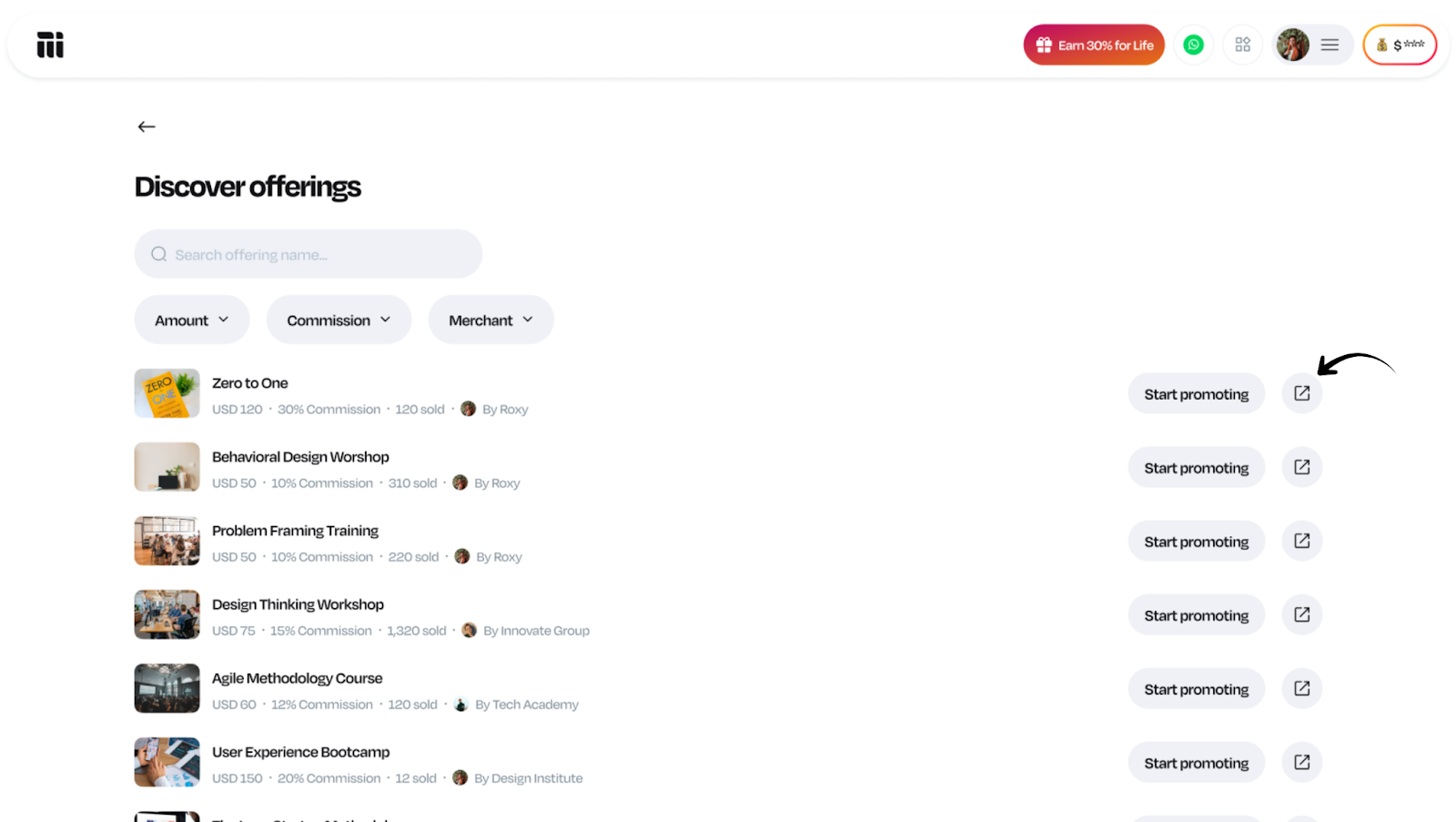

Once you find a product you’d like to promote, click on it to view more details and walk through its offer page.

Choose an offer and click ‘become an affiliate’ which gives you access to share your unique affiliate link.

From the moment a sale comes through, you earn. Mainstack pays you directly - fast, clean, and in your preferred method.

While others are waiting to “start earning online,” you could already be collecting.

The only thing between you and your next payout is a few clicks.

It’s a whole new ballgame.

For years, creators and entrepreneurs in Africa have been told the same story: “Build your product. Sell it. Repeat.” However, the truth is that the online world doesn’t reward hard work alone; it rewards networks, visibility, and speed.

And that’s exactly what Mainstack’s Affiliate Program is built for.

This isn’t just another earning tool. It’s a gateway to limitless sales and income, powered by collaboration.

You already created something valuable. Now, imagine hundreds of people selling it for you.

That’s what happens when you list your product on Mainstack’s Affiliate Marketplace.

Instead of doing all the marketing yourself, you tap into an army of affiliates ready to share, promote, and sell your product to audiences you might never reach on your own. Every time they sell, you earn effortlessly.

It’s not just marketing. It’s multiplication.

Your reach expands. Your sales grow. Your brand travels faster than your ads ever could.

And with Mainstack’s 24-hour payouts across Naira, crypto, PayPal, and DOM accounts, you don’t wait to see results.

HERE IS HOW TO LIST YOUR PRODUCT

If you have influence, community, or just good digital instincts, Mainstack gives you a new way to earn without creating anything.

You can promote digital products from verified merchants -from courses to eBooks to templates - and earn a commission for every sale.

No setup. No stress. Just pure earning potential.

Whether you’re a content creator, influencer, or someone who just knows how to connect people to what they need. This is how you turn your voice into consistent income.

The Mainstack Affiliate Program isn’t about links. It’s about liberation.

It’s about creators and merchants across Africa finally getting paid for the value they bring - without waiting on gatekeepers, ad budgets, or platforms that don’t understand our market.

It’s the freedom to earn faster, smarter, and together.

It’s the new way to sell. The new way to grow. The new way to win.

You can be part of the movement - or watch from the sidelines while others cash out.

Start now. Build smarter. Earn faster.

.png)

Ever scrolled online and thought, “I could sell that”? You’re not alone. Selling digital products makes it easy to turn your skills into income. And the best part? The market is booming.

The global digital content creation market reached $32.28 billion in 2024 and is projected to grow at 13.9% annually, creating massive opportunities for entrepreneurs to monetise their expertise.

In this guide, you’ll discover 15 profitable digital products you can sell, from e-books and courses to design templates and more. So, whether you're a graphic designer, educator, or creative professional, we've got you covered.

Let's be clear: we're not promising overnight success, but with effort and creativity, you can turn your skills into a thriving online business — and maybe even your dream lifestyle.

Digital products are intangible goods that exist in electronic form and can be downloaded or accessed online, rather than being physically shipped. They can include anything from ebooks, online courses, templates, and stock photos to music, software, or design assets.

Selling digital products offers creative freedom, global reach, and long-term business advantages without the limits of physical goods. Beyond that, digital products come with several standout advantages that make them a smart long-term business option.

Low Overhead and Higher Profit Margins

One major advantage of selling digital products is the low startup cost. There’s no need for materials, packaging, or shipping. Once created, you can sell it repeatedly with no extra expense, keeping more profit to grow your business..

Create Once, Sell Forever

Digital products let you earn passive income by creating once and selling repeatedly. For example, a single ebook or video course can generate sales for years without extra work. This model makes digital products highly profitable.

Growing Demand in the Creator Economy

Online education is projected to hit $185.2 billion in 2025. This is driven by the rise of the creator economy. As people seek online courses, templates, guides, and stock photos to simplify their lives, demand for digital products keeps growing.

Reach Customers Worldwide

Unlike physical products limited by shipping or customs, digital products can be delivered instantly worldwide. A photographer in Lagos can sell to London, or a designer in New York to Asia. This global reach expands your customer base and fuels steady growth. Before diving in, decide which type of digital product best fits your skills and goals.

Choosing what to sell is a key step in building a digital product business. Many beginners struggle with this, but it’s easier when broken into simple steps..

Start by aligning your skills or interests with what people need. If you’re great at design, for example, you could create design templates or branding kits. Writers can make ebooks, and experts can offer courses or training materials. Focusing on where your strengths meet audience demand helps you build something valuable and sustainable.

Before investing in a digital product, confirm there’s real demand. Check online communities like Reddit or Facebook for questions people are asking and recurring pain points. These signals indicate that people are actively seeking solutions.

If you don’t have an audience yet, you can still test your idea by joining conversations in relevant communities and sharing your idea to gauge interest. Validation helps you focus on products with real potential.

When choosing a digital product, decide whether it fits an active or passive model. Both can be profitable but suit different ways of delivering value.

Digital products under the active model require your direct involvement. Examples are coaching, live workshops, or consultations. In this model, you trade time for money, but in return, you can charge premium rates and build closer client relationships. This model suits creators who enjoy real-time interaction or hands-on teaching.

In contrast, passive digital products are created once and sold repeatedly with little extra effort. Examples are templates, stock photos, courses, or ebooks. They don’t depend on your constant presence and can generate income even while you’re offline, making them ideal for flexible, scalable growth over time.

Many beginners think they need to code or hire developers to sell digital products, but no-code tools have changed that.

Platforms like Mainstack, for example, let you upload your product, set your price, and deliver it automatically to customers. It’s a simple way to get started quickly without being bogged down by technical details.

Other useful tools include:

Now that you understand how to pick the right product, here’s 15 of the best digital products to sell online in 2025 and why they’re so profitable.

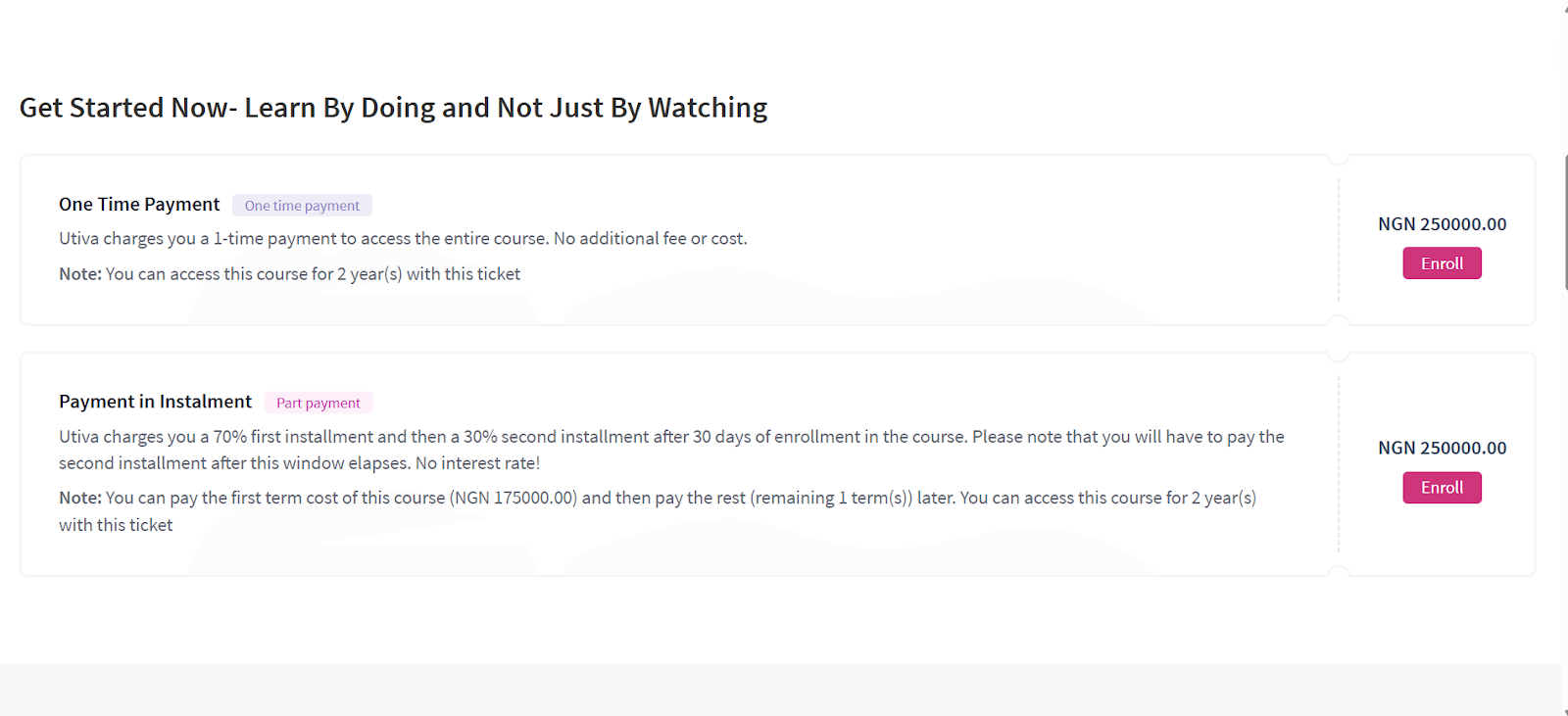

Online courses and tutorials are the best way to package your expertise and share knowledge through videos, slides, and resources. This is perfect for teaching skills like coding, design, or marketing.

To create an online course, choose a topic that is ever-green, in high-demand, and suits your expertise. As you work out the fine details of your course, create an outline, modules and a script.

Tools like Teachable help organize lessons and manage students, Loom simplifies video recording, and Canva makes creating slides and visuals easy.

Choosing the right platform to sell matters. For example, Udemy exposes courses to millions of learners but the competition is fierce. Meanwhile hosting your course on Coursera adds credibility through university partnerships but this comes with multiple restrictions.

With Mainstack, however, creators can host courses directly while maintaining full control over pricing, branding, and learner experience. Each option offers unique advantages, making online courses a flexible and appealing choice for creators.

Ebooks are the easiest and most profitable digital products to sell. They suit almost any niche and can generate passive income for years. If you have useful knowledge or experience, you can turn it into a guide or playbook people will pay for.

With e-books, the biggest advantage is accessibility. Unlike online courses, they’re easy to create, design and package for sale.

You can create an ebook using tools like Google Docs or Canva, then sell it repeatedly without extra cost. Platforms like Amazon KDP and Gumroad give access to large audiences, while Mainstack lets you sell directly with full control over pricing, branding, and customer relationships. This flexibility makes it easy to reach readers and earn consistently.

Templates and printables are pre-designed digital products that anyone can edit and customize to suit their branding or style—without starting from scratch. For example, it could be as simple as a Canva template for design or as complex as a website template for developers.

Templates and printables are easy to create yet highly valuable and in-demand. Start by looking for designs, systems, or workflows people already use and struggle to create from scratch. These gaps are great opportunities for templates.

Examples of templates in demand include:

Identify what your audience uses often, then create a plug-and-play version that saves them time.

Once you’ve picked a niche, tools like Canva, Figma, or Google Sheets make it easy to design and export editable templates. Platforms like Etsy, Gumroad, or Mainstack can help you sell directly to your audience and deliver files instantly.

Stock photos and videos are digital assets businesses and creators use for websites, social media, and marketing. This is a great way for photographers and videographers to monetize their skills.

Stock visuals are profitable because one file can be licensed and sold repeatedly, thereby creating steady income without the constant need to create new material.

Tools like Lightroom, Photoshop, and Canva make it easy to produce high-quality visuals, even for beginners. You can sell them on marketplaces like Shutterstock, Adobe Stock, or iStock, reaching a global audience of buyers.

Software and apps are digital products that solve problems or provide useful features, from productivity tools to entertainment. They can generate strong income through one-time purchases or subscription models that offer recurring revenue.

One disadvantage of developing software or apps is the need for technical skills or a development team, but the potential returns can be substantial. You can distribute apps through the Apple App Store, Google Play Store, or other software marketplaces.

Graphic design assets are pre-made digital elements like icons, fonts, logos, and illustrations that other creators, businesses, or marketers can use in their projects.

These products are highly sought after because they save time and provide professional-quality design without the need for advanced skills.

Popular examples are custom icon packs for websites, unique font families, logo templates and social media graphic sets

Designers who create these assets can tap into a growing market of small businesses, content creators, and agencies looking for ready-to-use visuals.

Tools to create: Adobe Illustrator, Figma, Canva

Where to sell:

Digital music and sound effects are always in demand for videos, podcasts, and ads. For creators with music production skills, this makes audio assets one of the most rewarding digital products to sell.

Royalty-free packs are a popular option. Examples include ambient background loops, cinematic tracks, or short sound effects like clicks, swooshes, or notifications. Each audio track can be licensed repeatedly, with the potential to earn repeatedly without extra work.

Tools to create: Logic Pro, FL Studio, GarageBand, Ableton Live

Where to sell: AudioJungle, Pond5, BeatStars and Bandcamp.

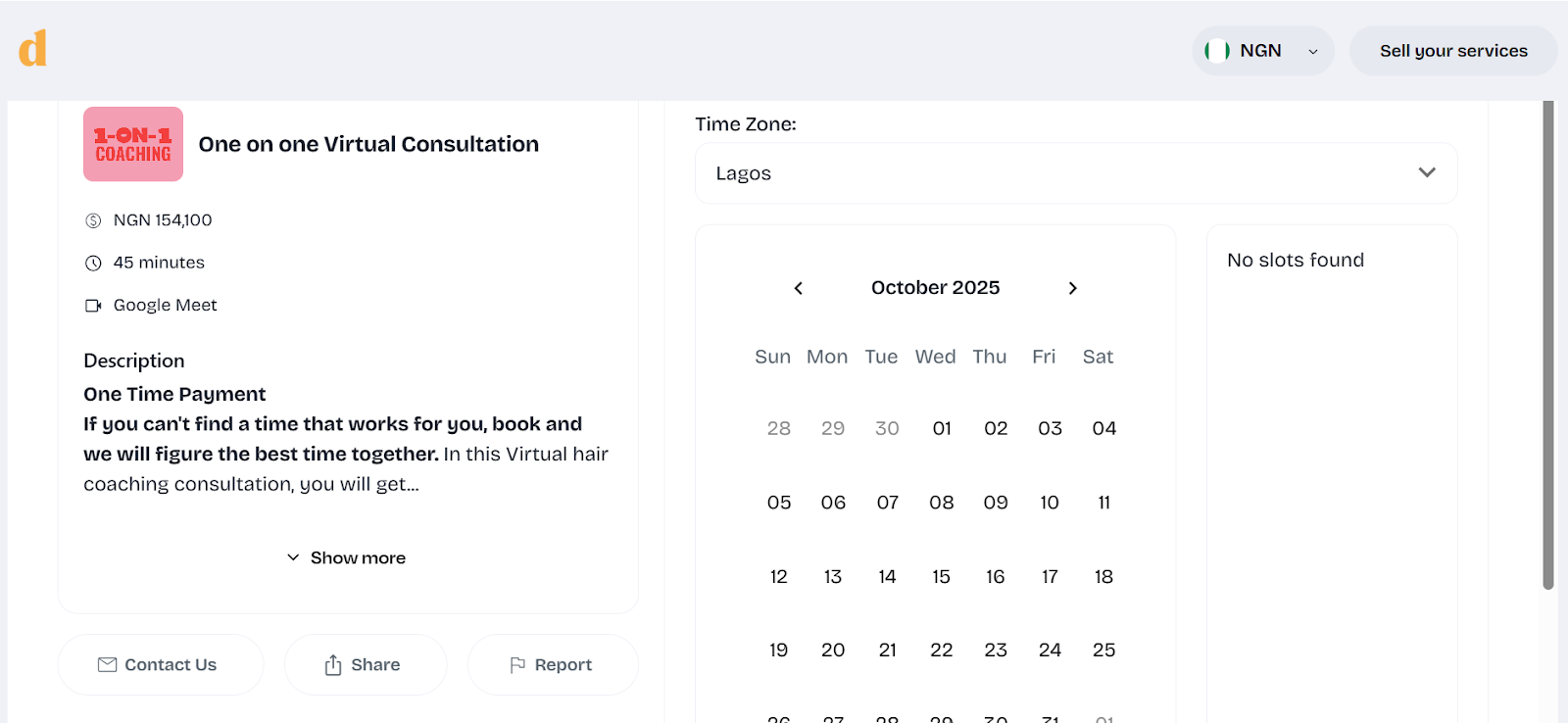

Coaching and consultation turn expertise into income. Instead of creating a generalized product, these packages give buyers personalized guidance tailored to their specific goals. Whether it’s career coaching, business strategy, fitness, or even wellness, the appeal lies in access to real-time problem-solving and accountability from someone with proven experience.

What makes these packages especially profitable is how they can be expanded beyond one-on-one sessions. Some coaches record live consultations (with permission) and sell them as replays, or bundle sessions with toolkits and frameworks so clients walk away with practical resources they can keep using. For example, a brand consultant might include a framework for content planning, while a career coach could offer a job search toolkit alongside their sessions. These extras add lasting value and make the package more than just a one-time conversation.

Tools to create & manage:

Where to sell:

Podcasts are one of the most versatile digital products because they fit seamlessly into people’s daily routines without demanding screen time. What makes them profitable is the variety of ways they can be monetized: creators can put episodes behind a paywall, sell bundles of recorded sessions, or offer ad-free versions to premium subscribers.

For example, an entrepreneur might run a private podcast series where they break down business strategies step by step, while a wellness coach could turn guided meditations into a subscription-only audio library.

Even entertainment-driven creators, like those in the true-crime niche, often release bonus episodes or early access content for paying listeners.

Tools to Create

Where to Sell / Monetize

Virtual events and webinars are great digital products because they combine education, interaction, and exclusivity. Unlike pre-recorded courses or podcasts, they happen live, which gives attendees the chance to ask questions, engage with the host, and feel like part of a community. At the same time, replays of these sessions can be sold afterwards, which means one event can continue generating income long after it ends.

Creators across industries use this model in different ways. A business strategist might host a live masterclass on scaling startups, charging for access and later repackaging the recording as a paid replay. Even artists and designers have found success hosting virtual workshops, where people pay to learn techniques live and then buy access to the replay if they couldn’t attend.

Tools to Create

Where to Sell & Host

Themes and plugins are some of the most profitable digital products because they solve real problems for website owners. A theme controls how a site looks — its design, layout, and style — while plugins extend functionality, adding features like contact forms, SEO tools, or e-commerce capabilities. With millions of websites built on platforms like WordPress, Shopify, and Wix, the demand for well-designed themes and plugins is constant. Businesses, bloggers, and online stores are always looking for ways to improve their sites without hiring a full development team, making these products highly valuable.

To meet this need, a developer might create a WordPress theme designed specifically for food bloggers, or a Shopify plugin that helps e-commerce stores upsell related products at checkout. Because these tools are reusable and meet practical needs, one product can be sold repeatedly to different buyers, generating long-term income.

Tools to Create

Where to Sell

Digital art and NFTs are often mentioned together but serve different purposes. Both let creators monetize visual work, yet they use different tools, markets, and selling methods.

Digital art is any creative work made with digital tools like illustrations, paintings, wallpapers, or printables. It’s in high demand among small businesses and individuals looking for posters, social media graphics, or desktop wallpapers, making it one of the most versatile and profitable digital products.

NFTs (non-fungible tokens) are digital assets tied to blockchain technology, giving each file unique ownership. Unlike digital art that can be sold repeatedly, NFTs are usually one-of-a-kind or limited edition, which adds to their value. Beyond art sales, creators also use NFTs for exclusive content, access, and community rewards.

Tools to Create

Where to Sell

Memberships and subscriptions are reliable digital product models because they generate recurring revenue instead of one-time sales. They give subscribers access to exclusive content, resources, or communities and work well for creators who produce consistent value like tutorials, premium articles, private podcasts, or resource libraries..

Examples include private newsletters, exclusive online communities, and specialized resource hubs with templates, videos, or coaching sessions. Since members pay for ongoing access, this model also builds stronger audience relationships.

Tools to create membership communities: Patreon, Substack, Memberstack, Ghost

Where to sell membership communities: Patreon, Substack, Mainstack

Digital magazines and newsletters are one of the most accessible ways to package and sell knowledge. Unlike blogs or free email, they focus on curated, high-value content that people are willing to pay for. This could be industry insights, lifestyle tips, or niche commentary.

A digital magazine can look like a monthly publication with in-depth features, interviews, and visuals, for a specific audience.

Newsletters, on the other hand, are email-based publications that can range from personal commentary to curated links, updates, or insights. They’re typically shorter, more conversational, and thrive on consistency, often arriving weekly or bi-weekly. Unlike digital magazines, they don’t have to be long-form or heavily designed.

Both formats work because they give readers something structured, reliable, and more focused than what they’d find by casually scrolling online.

Spreadsheets and calculators might not sound flashy, but they’re some of the most practical and profitable digital products out there. People are constantly on the lookout for ready-made tools like budget planners, content calendars, or ROI calculators that save time and effort.

Before you create a spreadsheet, identify a market that needs a spreadsheet. Are they finance enthusiasts? Small business owners who want to analyze cost? Define that.

Next is to design the copy, spreadsheet and tutorial to match the audience’s taste. Remember, the appeal lies in how easily these tools can be customized by the buyer.

Tools to Create Spreadsheets & Calulators

Creating digital products is half the work. The real challenge is reaching the right people and providing a smooth experience. A few core practices can make all the difference:

Digital products remove the limits of physical ones. Because it’s not limited by borders, you can sell globally. For creators, this means more freedom and greater control over how their value is shared.

And if you’re looking for a way to start selling, platforms like Mainstack do the heavy lifting. Mainstack helps you package, present, and sell your products without worrying about tech setup.

If you’ve been thinking about starting, now’s the time. Set up your Mainstack storefront; it takes just five minutes.

.png)

If you've ever asked yourself, "Why aren't my digital products selling?", you're not alone.

Selling online looks easy on paper. Create a product, upload it to your storefront, share the link, and wait for the sales notifications. But in reality, most creators and entrepreneurs quickly discover that selling digital products requires more strategy than luck.

Between rising ad costs, tough competition, and the constant need to promote, it's easy to feel stuck. But there’s a way out. Selling digital products successfully isn't about luck - it's about strategy. And often, a few small shifts can completely change your sales results.

Here are the 3 most common mistakes digital product sellers make, why they're hurting your business, and how to fix them immediately.

Many sellers believe that ads are the fastest way to drive sales, and there's some truth to that. Yes, ads can bring traffic, but here's the problem:

Ad costs are skyrocketing: You're paying more to get fewer results. Meta's average cost per click increased by 61% year-over-year in 2024, while conversion rates dropped.

Algorithms change overnight: What worked today may flop tomorrow. Platform updates can tank your campaigns without warning.

Bigger brands outspend you: Leaving small creators with negative returns. When you're competing against companies with six-figure ad budgets, your $500 monthly spend gets drowned out.

This results in burning money while your sales remain unpredictable.

Stop relying on ads alone. Instead:

Build organic discovery: Post valuable content, use SEO, and grow your audience. Content that educates or entertains builds trust and attracts buyers naturally over time.

Tap into partnerships and communities to expand your reach. Real communities exist where your ideal customers are already engaged:

These aren't random forums - they're active communities where your potential customers are already asking for solutions you've created.

Use affiliates as your personal sales team, but even better. With affiliate marketing, you only pay when a sale is made.

What top sellers do: Mainstack's Affiliate Marketplace allows you to list your products and let affiliates promote them to audiences you'd never reach on your own. You get instant distribution with no added cost up front.

Your price is more than a number; it's a signal. Price your product too low and customers doubt the quality. Price it too high without proof of value, and they'll walk away.

Many sellers fall into these traps:

The result is either low sales or low profits - sometimes both.

Price based on value delivered, not just market averages. Ask yourself: What specific outcome does my product create? What would that outcome cost if achieved another way?

Bundle products (like a course + workbook + templates) to justify higher pricing. Bundles increase perceived value significantly, making customers see more for their money.

Experiment with different price points and track conversion rates. A/B test your pricing. Sometimes a $97 product sells better at $147 because the higher price signals premium quality.

Important: Mainstack is hosting a live pricing + sales webinar with one of Africa's top sales coaches. This session will give you proven frameworks to price, package, and position your products with confidence. Keep an eye out for details - you won't want to miss this.

Another silent killer is relying on just one platform to sell. If Instagram is your only sales channel and the algorithm tanks, your income tanks with it.

Limiting yourself means: